With the introduction of UAE’s End-of-Service Benefits (EOSB) Savings Scheme under Cabinet Resolution 96 of 2023, employees across the UAE now have access to a powerful financial tool: Additional Voluntary Contributions (or AVCs, in short).

But what exactly are AVCs? How do they work? And why should HR support employees to take full advantage?

Let’s break it down.

Additional Voluntary Contributions

AVCs are what it says on the tin: Contributions, made voluntarily by employees, in addition to the contributions made under the rules of the scheme by their employers.

Here’s how they work:

- Once an employee decides to make AVCs, the contributions are automatically deducted from salary and sent to the Fund Manager. That’s why AVCs are also known as “salary sacrifice”.

- Employees can contribute up to 25% of their salary through monthly payroll deductions.

- Lump sum AVC contributions are possible, but might be subject to scheme specific AML and other requirements.

- Employees can choose which investment funds their AVCs go into.

- Unlike employer contributions, AVCs are voluntary and therefore, flexible. Employees can cash out their savings anytime, not just when they leave the company or retire.

Typically, EOSB Fund Managers will provide easy-to-use employee apps to monitor, invest, or withdraw AVCs. Hence, investing and cashing out AVCs will likely be a smooth process, and easily done at the fingertips of employees. We say “likely” as we haven’t seen all employee apps yet. Please stay tuned for future articles on this topic.

But why bother with AVCs?

You might be wondering: Why save through AVCs instead of a bank account or retail investment fund?

We at Pensions Monitor, believe that AVCs offer clear advantages:

- It’s automatic – once set up, savings are deducted from payroll. No reminders or manual transfers.

- It’s cost-effective – EOSB funds typically offer lower fees than retail funds due to wholesale pricing, and/or employer subsidisation.

- It’s simple – no complex insurance riders or hidden charges, just straightforward long-term saving.

- Matching? – if you are very very fortunate, your employer may match partly, some or all of your AVC contributions, to encourage you to save more. (Vesting schedules may apply.)

We say simple when compared to life insurance plans that carry a savings element. Granted, such life insurance plans come with other features (such as, a death benefit or other insurance covers and riders), however, such products provide limited protection and are essentially insurance-wrapped savings instruments. Compared to such products, AVCs are usually superior, as they are simpler, cheaper and your investment is accessible – yet do the same job.

That said, the current investment options in UAE’s EOSB Savings Scheme are limited. Except for Lunate, fund managers haven’t yet launched risk-based funds. So its a far cry away from the array of investment funds offered by banks, which can go into the hundreds of funds. But we expect the EOSB fund lineup to expand over time, becoming more competitive and versatile.

AVCs can supercharge your savings. Start early

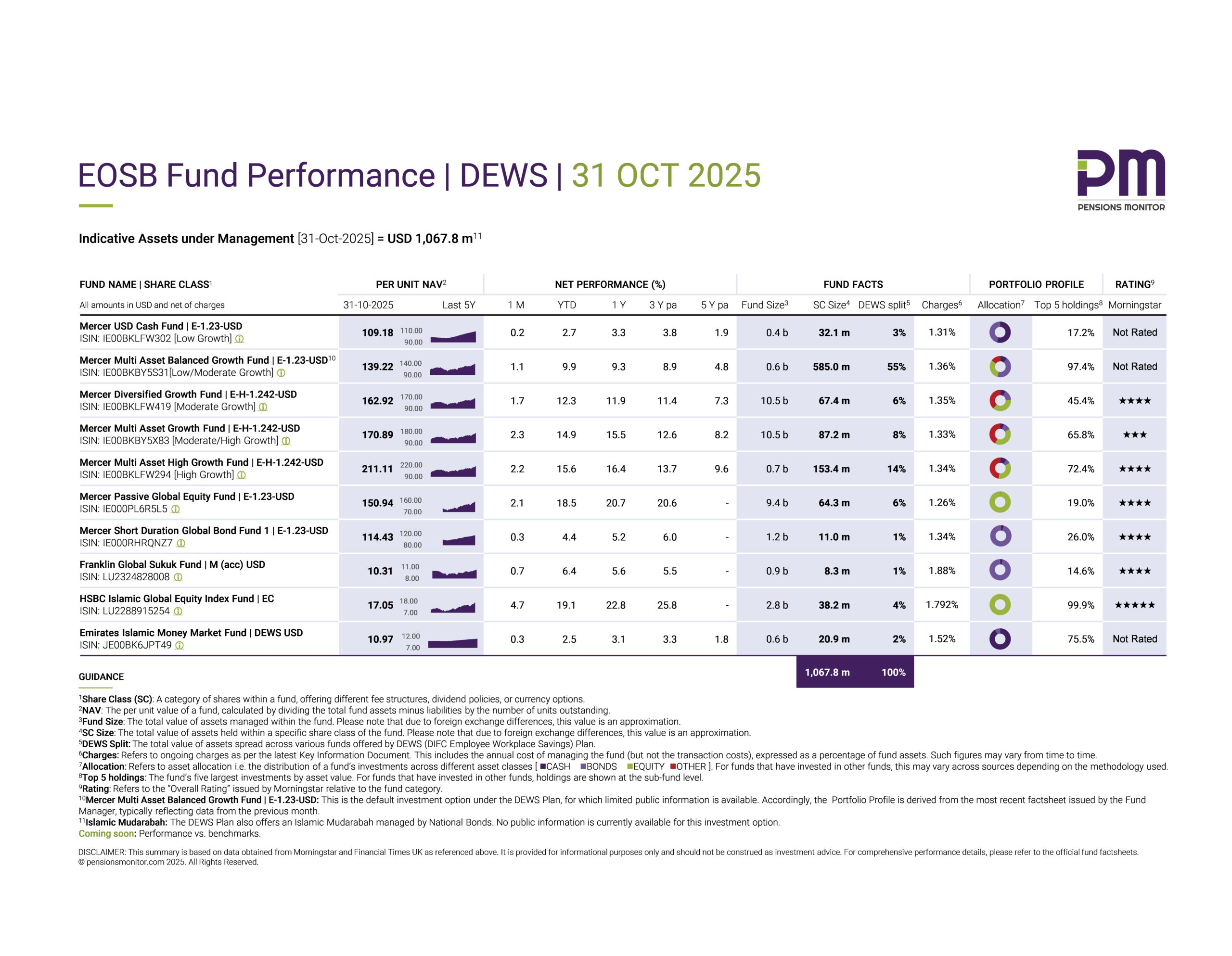

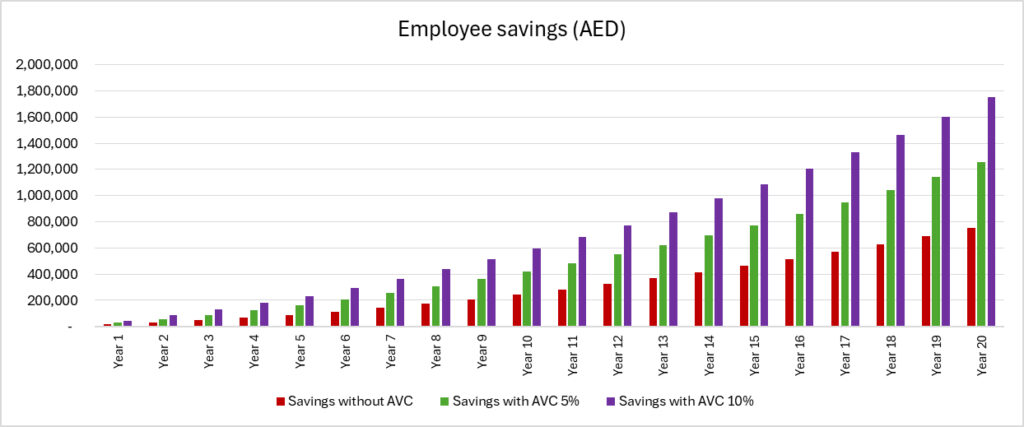

Let’s see how AVCs can impact long-term savings with a quick example:

- Let’s say an employee earns a salary of AED 250,000 per year.

- The salary increases year after year by 2%.

- The employer contributes the mandatory 5.83% of salary for the first 5 years, 8.33% thereafter.

- The contribution is invested in a fund that achieves a return of 5% per year, net of charges.

Employee savings after 20 years:

- No AVCs: AED 754,000.

- With just 5% of salary into AVCs, the total savings pot would reach AED 1.25million.

- With 10% of salary into AVCs, the pot could reach AED 1.75milion, a substantial sum indeed.

That’s more than double the savings with just a modest AVC!

The role of HR

Now, AVCs are set up through employer-selected fund managers and handled through payroll — which means HR is at the heart of making it accessible to employees.

At Pensions Monitor, we believe that HR teams also play an important role in supporting employees’ financial wellbeing by providing information, raising awareness about AVCs, and encouraging a culture of financial responsibility.

Of course, HR doesn’t need to give financial advice, that’s not expected. But it’s important to understand the basics and know where to point employees for help.

Don’t worry, Pensions Monitor is working on tools that will make this even easier for HR teams. Stay tuned!

Conclusion

AVCs are one of the simplest, low-cost savings option that can be made available to all employees in the UAE, through their employers. With automatic payroll deductions, they offer a great opportunity to build long-term wealth (and save for retirement) with minimal effort.

While it’s true that the current range of EOSB funds is still developing, the landscape is evolving quickly. And once the UAE’s EOSB Savings Scheme becomes mandatory, every employee will eventually have access to AVCs.

So now is the ideal time for HR to get ahead: understand the scheme, engage employees early, and be ready as more investment options become available.

Sign up to our free newsletter to stay up to date with insights, tools, and updates on EOSB Savings Schemes and employee financial wellbeing in the UAE.

Cover photo from DMCC’s “End-of-Service Benefits and Pensions under UAE Labour Law” awareness session held on 10 April 2025, led by Stephenson Harwood, featuring a guest speaker from Pensions Monitor.