On 8 May, a select group of HR leaders from major organizations across the UAE convened for an intimate workshop to discuss advancements in End of Service Benefits (EOSB). Hosted by international law firm Stephenson Harwood and global talent solutions firm Robert Walters, the event took place at the vibrant One Life Kitchen and Café in Dubai Design District.

Emily Aryeetey, Partner at Stephenson Harwood kicked off the session with an overview of the evolving EOSB landscape, and Pensions Monitor’s Nisha Braganza joined as guest speaker to share recent market developments and the mechanics of the various EOSB schemes in the UAE.

What made this session particularly insightful was the diversity of voices in the room—HR professionals from DIFC, the mainland, and a range of other freezones—all exchanging their perspectives and challenges, on this important topic.

Here are the top 3 things that stood out:

- Larger employers are moving early. Many HR leaders—especially those at companies with 250+ employees—have already begun internal evaluations in response to the new EOSB regulations. Some companies are conducting internal studies and planning how to go about implementing an EOSB savings-based model. The mindset? Definitely proactive – but also filled with questions. Most are looking to find out what other companies are doing, and want clear guidance on how to move from theory to execution.

- Strong cross-jurisdictional curiosity. The attendees also showed strong interest to learn how EOSB changes are unfolding in different jurisdictions – DIFC, ADGM, mainland and the other freezones. Many of these large corporates operate across multiple zones in the UAE, and a common concern is ensuring consistency in how they offer employee benefits across the board.

- Freezone clarity is missing. The event also spotlighted another challenge: Many HRs voiced uncertainty about what’s currently applicable to them in their respective freezone. HR leaders expressed concern about mixed messaging and regulatory silence in some zones.

Well, this discussion couldn’t be more timely — Pensions Monitor has just completed its research on EOSB developments across UAE freezones. We’ll be sharing those insights in our next article. Stay tuned!

Wrapping up

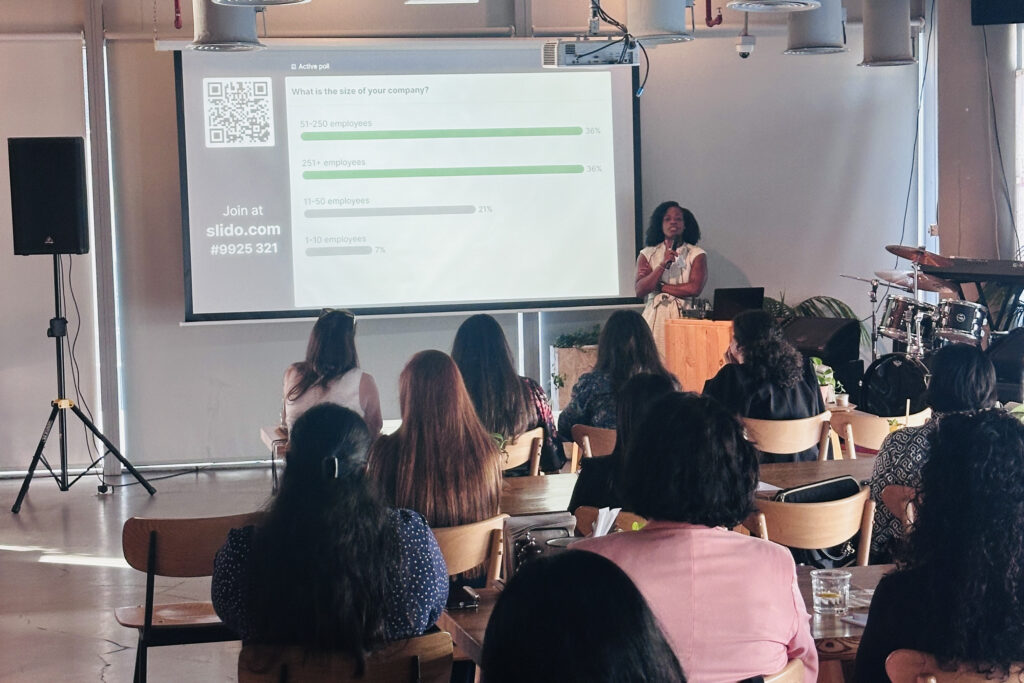

The session also included live-polling, which brought to attention the specific areas where companies need support – especially in terms of ensuring compliance, understanding scheme options, and getting buy-in from leadership.

If you’re a HR professional and responsible for EOSB planning, now’s the time to plug into these discussions, stay informed about what the other companies are doing, and start shaping your company’s EOSB approach. The transition toward funded, savings-based EOSB schemes is picking up momentum—and being ready means:

(a) understanding what’s happening across all zones, not just your own; and

(b) crafting EOSB strategies that are not only compliant but also aligned with your employees’ expectations.

Interested in taking part in the next EOSB session?

If you are a HR professional and you’d like to join the next EOSB awareness session (date to be announced), drop us an email at info@pensionsmonitor.com with subject line “EOSB” and details of your company name and number of guests that would like to attend.

And, if you found this article useful, feel free to share it so others can stay informed too and sign up for our free newsletter to stay on top of all things EOSB.

Image gallery: Beyond Gratuity