As promised, today we release the first edition of the fund performance dashboard for GO SAVER — the second official End-of-Service Benefits (EOSB) savings plan in the DIFC (Dubai International Financial Center) that was launched in January this year.

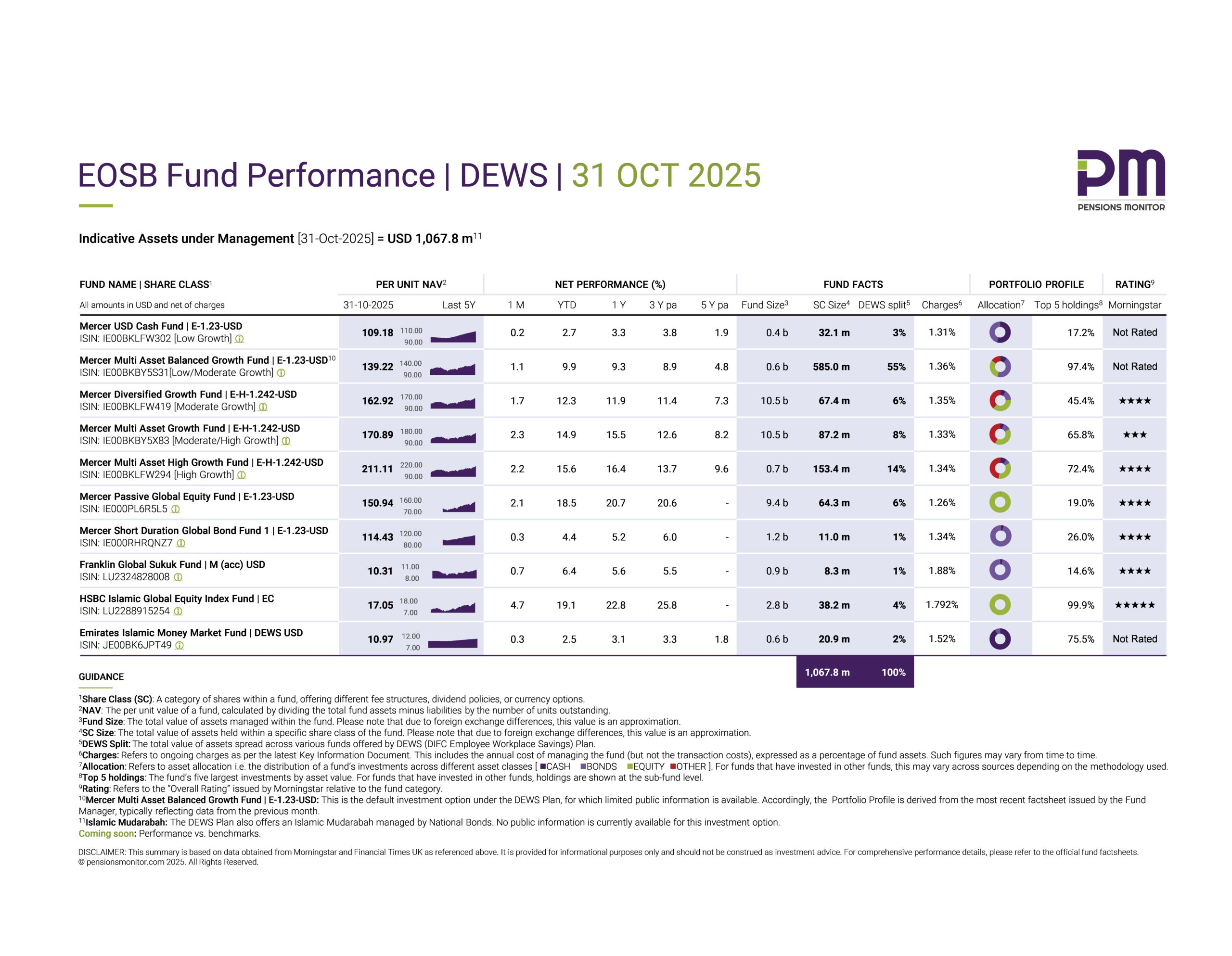

We have already extensively written about the first plan – DEWS which was launched 5 years ago (see here, for example). It is encouraging to see a second provider entering the fray in the DIFC.

Putting this dashboard together wasn’t easy. GO SAVER is structured quite differently from DEWS, so in this first edition we’ll explain the technical details – what sets this plan apart, the structure, the fund offerings and the fee structure. Hence today’s article will be seem a bit nerdy, but we hope to have the mechanisms explained in a way so that everybody understands.

Please note that much of what you’ll find in this article is not publicly available and has been sourced directly from the GO SAVER team.

👉 Click here to download the dashboard.

GO SAVER: A new plan, with experienced funds

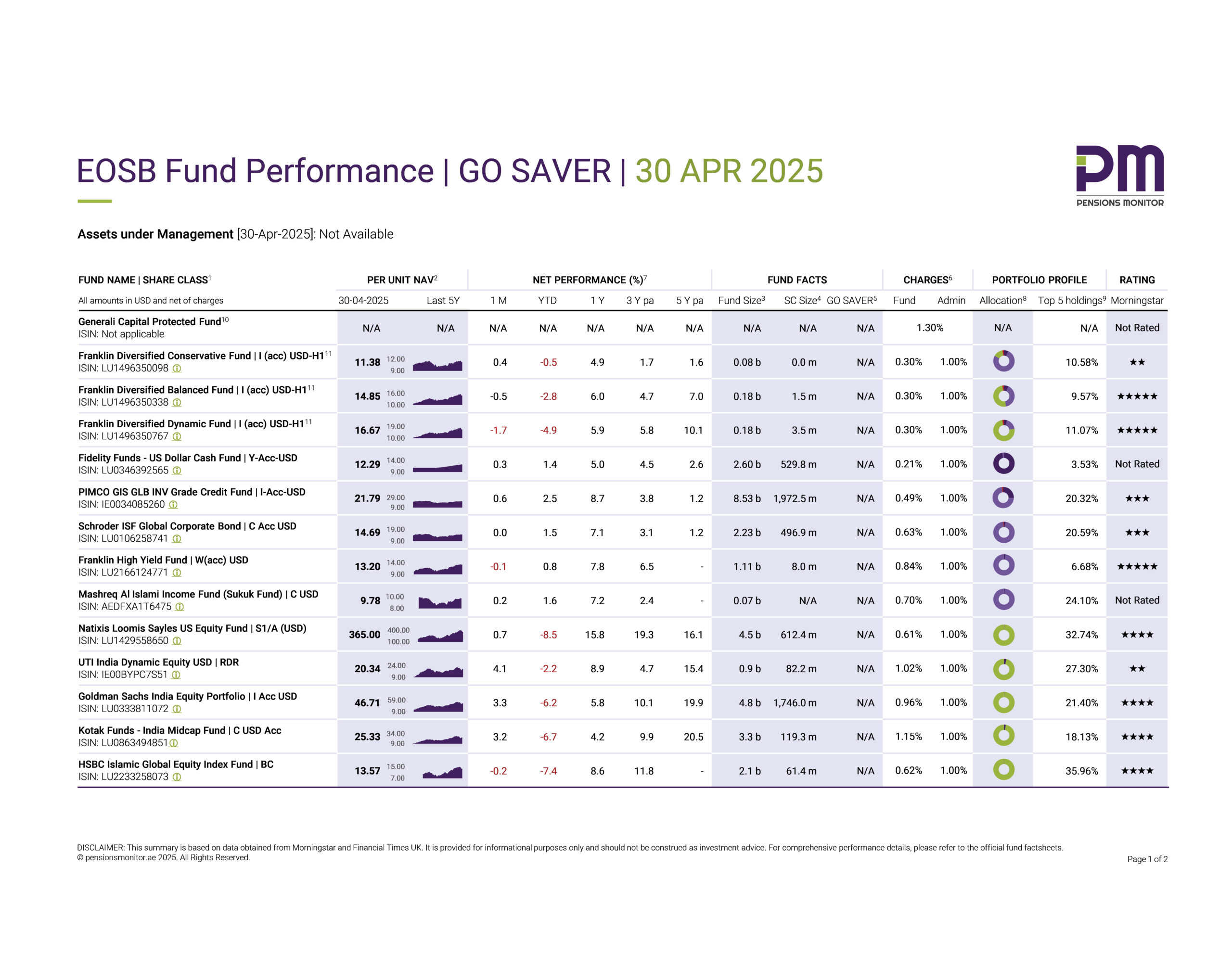

The most striking takeaway from this dashboard is that while GO SAVER is a relatively new EOSB savings plan, the funds it offers are not. The funds on offer, come from well-established global asset managers like Franklin Templeton, Natixis, Fidelity, Schroders and others, and most funds are tried-and-tested and have track records of over five years as reflected in the dashboard. This means that despite GO SAVER’s recent launch, members have access to credible historical performance data to make their investment decisions.

This track record is available because GO SAVER has not created separate share classes for its funds, meaning that members invest in the funds on exactly the same terms as global investors. However, this structure comes with a trade-off: the absence of separate share classes means there is no public data specific to GO SAVER’s investments. So, we are (and will be) unable to estimate the GO-SAVER’s total Assets under Management (AuM) or track its month-on-month growth.

Nevertheless, we’ve been informed that GO SAVER’s AuM is building. Companies have reportedly already begun regular contributions to GO SAVER, including some that had been contributing to DEWS – although the transfer of the accumulated savings from DEWS to GO SAVER is still pending. Note: we have been informed that the transfer process from DEWS to GO SAVER, and vice versa, will be available in the coming weeks. (Once finalized, we will explain in a separate article, how this transition works and what DIFC companies and employees need to know if they wish to switch providers).

What investment options are available?

We announced the fund offering of GO SAVER in a previous article in February 2025. The offering is indeed quite diverse. Broadly the funds are grouped into three categories:

The default option:

The Generali Capital Protected Fund is the default for members who do not actively choose their investments. This is one of GO SAVER’s standout features. Managed by Generali, an Italian insurance and investment powerhouse with worldwide operations, this fund offers 100% protection of capital and annual gains, which are locked in and compounded over time. However, this fund is not publicly available and does not carry an ISIN (a unique fund identifier, through which one can easily track documentation and performance metrics if publicly available), so performance data is not publicly available. We have requested for the information and hope to share updates in our next dashboard. In any case, it is worth noting that GO SAVER has a capital guarantee option, whilst DEWS does not. Instead, DEWS offers money-market funds that are also relatively safe.

Risk-based funds:

These include three risk-based options — Conservative, Balanced, and Dynamic — managed by Franklin Templeton, the plan’s Investment Manager. Please note that the data presented in our dashboard reflects the publicly available “I” share class. While GO SAVER invests in the “J” share class—details of which are not publicly available—it has been confirmed that the “I” share class provides a reasonable proxy in terms of net performance and with the “J” share class having a lower fee.

Self-select funds:

In addition, 11 other funds are available for members who prefer to create their own investment mix, covering a variety of asset classes, industries and geographies. These include funds from fund houses like Fidelity International, PIMCO, Schroders, Natixis, UTI International, Goldman Sachs, Kotak, HSBC and Mashreq Capital.

It’s worth noting that the count of the self-select funds has come down to 10 from 12 (see previous article), following the removal of some underperforming funds. The decision was taken by CSC, the scheme operator, with assistance from Enhance Wealth Consultancy Limited (Enhance), an independent consultant engaged to provide oversight and fund evaluation support. Enhance operates at arm’s length from fund managers, helping to ensure the selection process remains objective and aligned with the best interests of GO SAVER members.

Understanding the fee structure – what’s different?

Since GO SAVER hasn’t created separate share classes within the funds, members pay exactly the same fund management fees (fund fees) as global institutional investors. However, managing an EOSB savings plan involves more than just fund fees. The additional costs of administering and operating the scheme (referred to as the administration fee) therefore have to be charged separately.

The GO SAVER administration fee is a flat 1.0% per annum for all investment options, except for the default fund. This accrues to Sukoon Workplace Savings (the plan administrator), and CSC (the Trustee).

Please note that this fee is not deducted within the fund Net Asset Value (NAV), but is instead recovered by selling units from a member’s account each month, equivalent to the 1.0% annual charge. This means that plan members will see a few units sold each month, the sale proceeds of which accrue as administration fees.

As such, the fund NAV and net performance figures shown in the fund factsheets — and reflected in our dashboard — are net of fund management fees, but not administration fees. So, when comparing the “Net Performance (%)” of GO SAVER funds with another EOSB plan, as a rough estimate, an additional ~1.0% should be deducted to account for administration fees. But do note that this is a crude approximation and may not always hold true, due to price fluctuations during the year.

For the default fund, the fee structure is different. All fund-related and administration fees are capped at 1.30%. This fee is paid by the fund from its returns and not deducted from member contributions. Given the added layer of insurance-backed capital protection for this fund, this fee appears competitive — though the real value of this investment option will become clearer once performance data is available.

So how did the GO SAVER funds perform in April 2025?

As mentioned, the GO SAVER fund offering is broad and diverse and merits a deeper dive in a separate article.

For now, a quick overview: Performance of the funds (where data is available) has generally aligned with market trends. Equity-heavy funds have posted negative Year-to-Date (YTD) returns, but showed signs of recovery in April. Bond-oriented funds have performed better, offering a cushion during the recent market volatility.

In future articles we will look into the fund performance in more detail, including comparisons and benchmarks.

Final thoughts

GO SAVER makes for a strong alternative for companies and employees seeking more investment choices, including a capital protection and third-party oversight. While there are some limitations — such as lack of plan-level AuM data and a slightly more complex fee structure — the depth and diversity of investment options, along with their established performance history, make the plan worth watching.

To learn more about GO SAVER or to connect directly with the team, visit: www.sukoonworkplacesavings.com

Another important aspect when comparing EOSB savings plans is the quality of administration. For instance, the ease of HR processes such as uploading monthly salary data and the service quality in case of troubleshooting issues. We will look at these aspects in more detail in future articles.

Stay tuned and sign up for our free newsletter covering all EOSB developments in the UAE.