Today’s article is authored by Ruan van Rensburg, CEO of Lux Actuaries Financial Consulting. The AUM model referenced in this article can be obtained from Nisha Braganza, Editor-in-Chief of Pensions Monitor. Please email Nisha at nisha@pensionsmonitor.com to request for the same.

Background

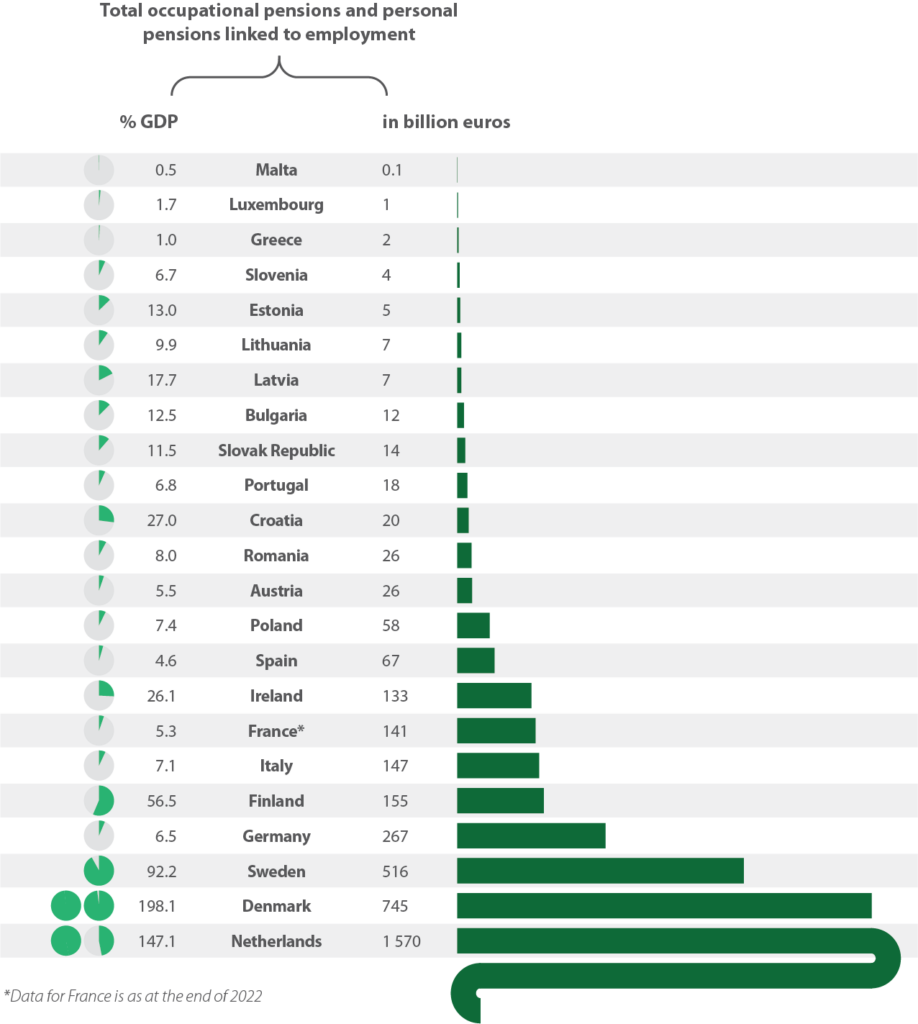

A recent special report by the European Court of Auditors on Developing Supplementary Pensions in the EU provided a very interesting illustration, reproduced below. What this presentation shows is the percentage of GDP that various countries in the EU have saved, for occupational and personal pensions linked to employment, in the country in question. So, for example, Latvia has saved up 17.7% of GDP while Ireland has saved up 26.1% of GDP. Those thrifty Danes and Dutch seem to have the most saved up at 198% and 147% respectively. (This graph ignores state and social security and personal savings.) The special report also quotes directly one of the core reasons why it is critical to support and grow these schemes, and you can directly replace EU with UAE: “Pension schemes play an important role in social protection and strengthening the EU’s capital markets”.

Figure 3 – Value of EU occupational pensions and personal pensions linked to employment, relative to GDP and in absolute terms (as at end of 2023).

Source: ECA, based on Organisation for Economic Co-operation and Development.

What this gives us is an interesting benchmark against which to compare the UAE and the intended new End-of-Service Benefits (EOSB) Savings Scheme as set out in Cabinet Resolution 96 of October 2023.

UAE GDP

IMF (The International Monetary Fund) reports UAE’s GDP at current prices to be USD 514bn and USD 537bn as at the end of 2023 and 2024 respectively. There are of course many nuances, such as the contribution of energy to this GDP, but USD 500bn is a convenient starting point for our benchmarking.

Current situation

Currently, the EOSB Gratuity for the UAE private sector is paid by employers, mostly on a pay-as you go basis. The accrued liabilities for these state-mandated benefits are presented on each employer’s balance sheet, and most of these schemes are unfunded – meaning there are no assets backing the liabilities. We at Lux Actuaries assessed these liabilities as being in the order of USD 100bn in 2019, though with interest rates increasing from that historical assessment balanced by UAE economic growth, the liabilities might be similar or perhaps slightly lower, when assessed on an IAS 19 (IFRS) basis.

This gives an overall private sector liability of around 15% to 25% of UAE GDP under the existing EOSB Gratuity system. Again, it’s important to emphasize that these liabilities are mostly unfunded.

The new EOSB Savings Scheme

Since October 2023, the expected AUM market size of the new and currently voluntary EOSB Savings Scheme have been discussed with great interest, and estimates seem to vary from USD 80bn to USD 100bn – on a compulsory basis. Tracing the source of those early expectations is difficult, and so we at Lux Actuaries Financial Consulting decided to build a cash-flow model specifically for this purpose, and we are making this model available to the industry and to the public via Pensions Monitor, in the first instance.

To request for this model, please email Nisha Braganza at nisha@pensionsmonitor.com or ruan@luxactuaries.com.

The inputs to the model are hopefully self-explanatory, but can be easily modified with your own assumptions and inputs. Please also familiarize yourself with the limitations of this model and take substantial care in using any of its outputs.

The model, version 17F, indicates that with conservative assumptions, it will take around 7 or so years to reach USD 100bn in AUM. This assumes low’ish real returns (0.5%), minimum cash retained when people leave employment and the UAE (8.3% only), and also zero transfers in from the current gratuity system. The providers that are able to convince employers to transfer existing benefits into the new scheme, and/or convince leavers to retain their savings in the UAE, will have an altogether better experience in terms of AUM and hence profitability. There are many factors that influence/dictate the corporate transfer decision or retail retention decision, and professional financial advice is recommended.

All this means that at most in 7 years, and potentially sooner, the EOSB Savings Scheme (by definition fully funded, in contrast to the current EOSB Gratuity system) will reach AUM of around USD 100bn or 20% of current level GDP (USD 500bn) and perhaps somewhat lower by future GDP. This is aspirational and puts the UAE in good company compared to the EU percentages shown above. A 20% of GDP savings level hovers between Ireland and Latvia – for Pillar 2 savings at least. (Please see earlier article by Pensions Monitor or the rest of the EU Special Report for Pillars 1, 2 and 3 details).

If we, as an industry can save and manage 20% of UAE’s GDP, then we will, apart from profits, play an important role in social protection and strengthening of the UAE’s capital markets.

Pensions Monitor Comment

This article has been authored by Ruan van Rensburg, CEO of Lux Actuaries Financial Consulting who assumes full responsibility for its contents and for the accompanying AUM model. Lux Actuaries Financial Consulting is a Category 5 SCA Financial Consultations licensed entity, staffed by qualified and experienced actuaries.

In case of questions on this article, please contact Ruan directly on ruan@luxactuaries.com.

And if you, dear Reader, have some interesting views, or thought-provoking takes on the EOSB Savings Market, then do write to us at info@pensionsmonitor.com. We will gladly consider featuring your article on our website.