With the UAE’s new End-of-Service Benefits (EOSB) Savings Scheme now in motion, employers have a timely opportunity to rethink their employee benefits strategy.

At its core, the scheme replaces the traditional gratuity model with a regulated, investment-based approach. These licensed EOSB investment funds are designed to ensure that employee savings are not only protected but also have the potential to grow over time, shielding them from inflation and offering a more substantial nest egg upon leaving employment.

And while making employer contributions under the scheme is a matter of compliance, companies looking to stand out can go further, by using the new scheme to upgrade their employee benefits strategy, attract top talent, boost retention, reward top performers and create long-term value for the business.

Here’s how.

Offer your employees a government-subsidised scheme to save more

At the heart of this new scheme is the opportunity for employees to take a more active role in their financial future. Besides the mandatory contributions made by employers, employees have the option to voluntarily contribute under the scheme, leveraging the relatively lower-cost investment options to build up their savings pot. Such voluntary contributions made by employees are typically referred to as Additional Voluntary Contributions (AVC). We explained why AVCs are a powerful financial planning tool for employees in a previous article.

Employees can choose to contribute up to 25% of their total salary as an AVC. These AVCs are usually deducted from payroll and go straight into their personal investment pot, so it’s convenient and automatic.

This is especially valuable for employees looking to accelerate their long-term savings, and it’s an easy benefit to enable from your side as an employer. The scheme is designed to be flexible and low-touch for payroll teams while giving your workforce an upgraded savings experience.

Consider paying some scheme costs

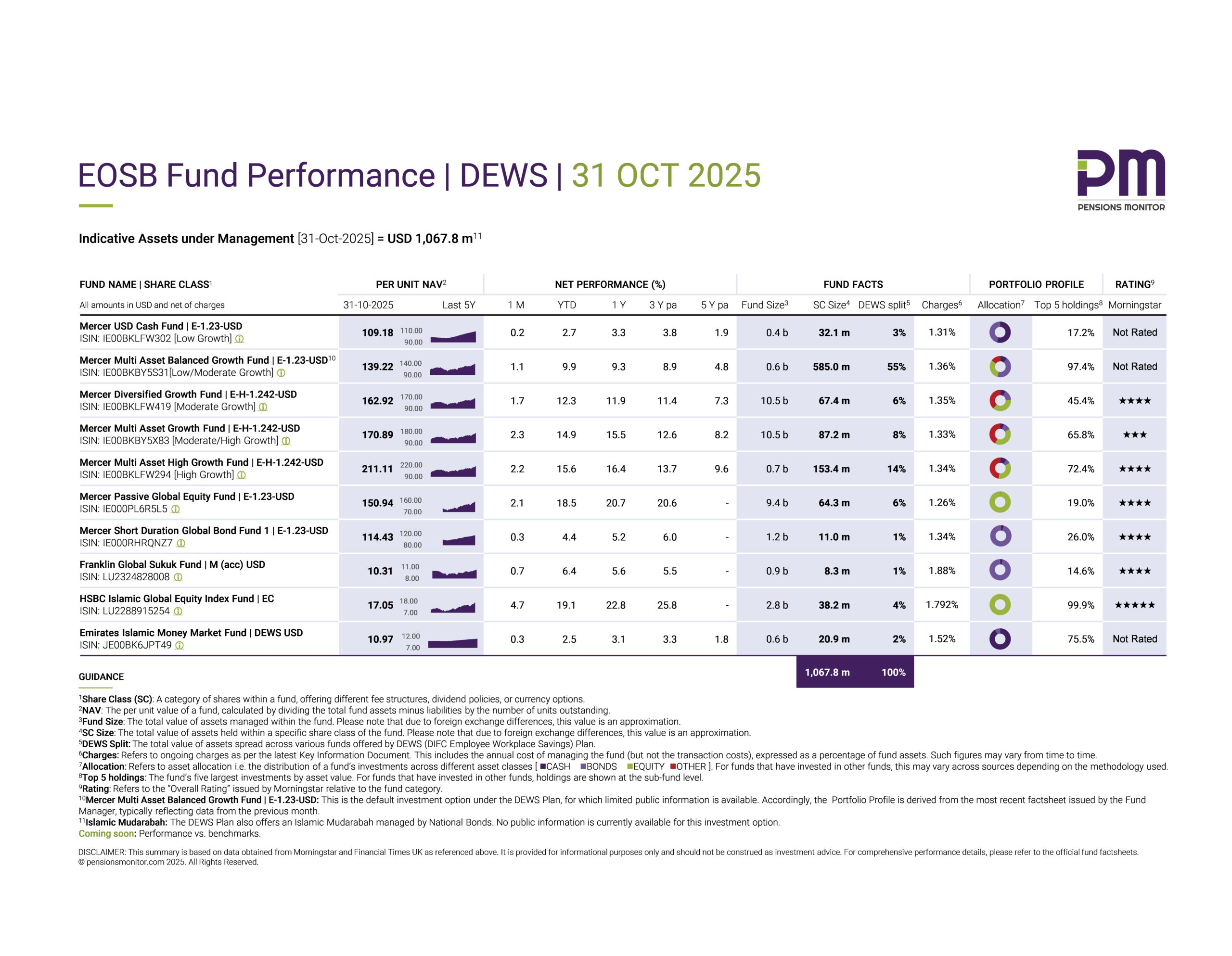

All investment funds are subject to fees for investors – it’s unavoidable; in this case it’s the employees who get charged the fees that are netted off from the returns of their EOSB savings. And strictly speaking, once an employer has made the mandatory contributions of 5.83% or 8.33% on behalf of its employees (depending on employee service tenure), then the employer’s legal obligations end.

But choosing to absorb part or perhaps all of the scheme’s annual fees is a very smart way for an employer to distinguish itself from other employers because this simple move improves financial outcomes for employees, and positions your organisation as one that goes the extra mile.

For example, if the annual fund fees total around 1% of savings (technically speaking, 1% of Assets under Management or AuM), an employer could choose to pay half, or all, of that cost. For companies, it’s a relatively modest spend that will boost employee retention, morale, and financial wellbeing.

Match AVCs to build loyalty: The golden handshake

Another particularly attractive though not-mandatory feature of the scheme, is the option for employers to top up their contributions. Employer top ups can be tactfully deployed to match partly or all your employees’ AVCs, perhaps doubling that portion of their savings, to improve retention of your top talent.

For example, an employer could offer to match say, 50% of an employee’s AVCs up to a set cap. This “golden handshake” sends a clear message about your company’s commitment to employee long-term financial wellbeing and will encourage employee loyalty.

So, while matching AVCs is not a requirement under the law, it’s worth considering if you want to reward longevity or if your company is in a competitive hiring market.

Compel your top talent to stay longer

A key concept here to understand is that of “vesting” which determines when an employee gains full ownership of the contributions made by their employer. Under the new scheme, the mandatory contributions made by the employer vest immediately, meaning that the funds belong to employees from the moment they are contributed to the scheme.

This immediate vesting provides a greater sense of security and transparency for employees, knowing that their EOSB is secure and growing in their name from day one of their participation in the scheme.

But matched AVCs can be structured differently with a vesting schedule of 3 to 10 years to encourage employees to stay with their employer for longer. This means that the employee would have to remain with the company for a specified period before they are fully entitled to the employer’s matching contributions – and this is an ongoing rolling vesting process. A great way to encourage loyalty and long-term employment indeed!

And yes, it’s tax-deductible!

There’s another good reason for employers to consider matching AVCs. Employer EOSB contributions to funds, whether mandatory or matched, are generally tax-deductible under UAE Corporate Tax rules, subject to certain conditions. We discussed this in a previous article.

This tax benefit makes offering additional benefits under the new scheme, a cost-effective and government subsidised way to invest in your people, and your business.

Final thoughts

The UAE’s new savings scheme offers HR Leaders a great opportunity to turn EOSB compliance into a smarter employee benefits strategy. It enables companies to restructure end-of-service benefits as a strategic tool to support talent acquisition and retention, enhance employee financial wellbeing, and strengthen employer branding.

Whether you choose to match AVCs or subsidise fees for your employees, each step you take will signal long-term commitment and help your employees to build trust and loyalty towards your organization.

Found this article useful?

Please share it so others can stay informed too and don’t forget to sign up for our free newsletter to stay on top of all things EOSB.