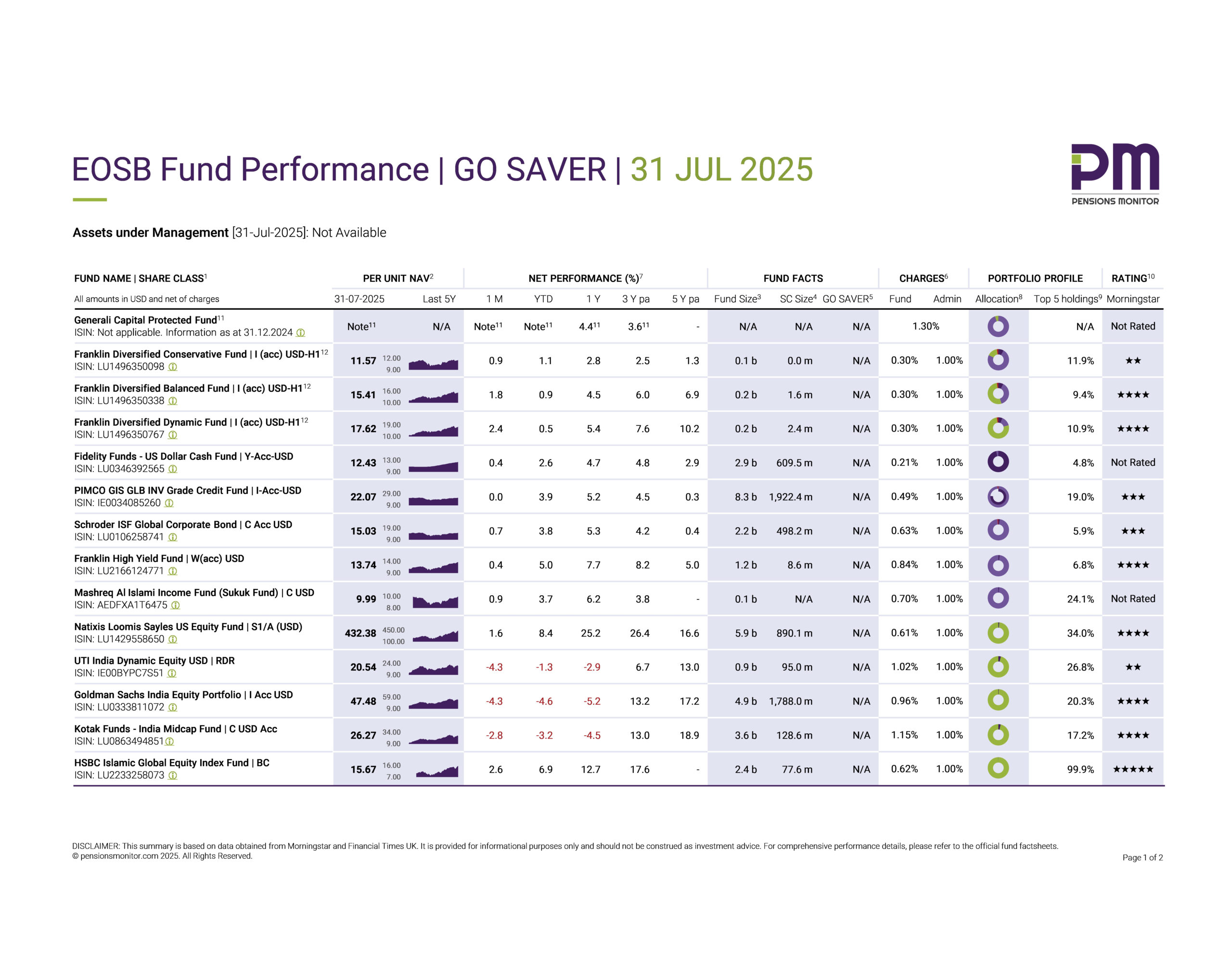

EOSB Fund Performance | GO SAVER | 31 JUL 2025

After reviewing the performance of DEWS for July, let’s now turn to GO SAVER, the other official End-of-Service Benefits (EOSB) Savings Plan available in the Dubai International Financial Centre (DIFC) operated by Sukoon Insurance.

👉 Click here to download the dashboard.

Generali Capital Protected Fund

This is the default investment option of GO SAVER.

As mentioned in our June update, the Generali Capital Protected Fund is an insurance-based investment vehicle. Such funds typically report performance data on an annual basis, and that remains the case so far. The last available data is still as at 31 December 2024.

That said, GO SAVER reports that they are working, against the odds, to publish performance updates more frequently. We will share an update as soon as new data drops.

Franklin Templeton’s Diversified Funds

Moving to the diversified funds, all three options under GO SAVER – conservative, balanced and dynamic – have performed well in July with gains of 0.9%, 1.8% and 2.4% respectively. This pushes all three into positive Year-to-Date (YTD) territory.

Fixed Income Funds

Bond-based funds are also called Fixed Income Funds. GO SAVER offers four such funds, including one Shariah-compliant Sukuk option.

With the exception of PIMCO GIS Global Investment Grade Credit Fund, which remained flat in July (more on that below), the other funds have continued their steady climb:

- the Schroder ISF Global Corporate Bond Fund returned 0.7% in July bringing the YTD performance to 3.8%;

- the Franklin High Yield Fund returned 0.4% in July and 5.0% YTD;

- the Mashreq Al Islami Income Fund gained 0.9% in July and 3.7% YTD.

The PIMCO fund posted 0.0% return in July, likely due to its heavily hedged and leveraged structure, which aims for stability and capital preservation even in sideways markets.

Equity-based funds

Let’s break these down by region.

U.S. market focus: Both the U.S. centric funds had strong gains in July:

- the Natixis Loomis Sayles US Equity Fund gained 1.6% this month alone, bringing the YTD to an impressive 8.4%.

- the HSBC Islamic Global Equity Index fund gained 2.6% in July and an equally impressive 6.9% YTD. As mentioned previously, this fund is also available under DEWS, though under a different share class that carries higher charges (1.792%).

India market focus: India was the exception to an otherwise positive month for GO SAVER. All three India-focused funds posted negative returns in July:

- the UTI India Dynamic Equity: -4.3%

- the Goldman Sachs India Equity Portfolio: -4.3%

- the Kotak India Midcap Fund: -2.8%

As a result, all three funds have slipped deep in negative territory YTD.

This decline is largely due to the depreciation of the Indian Rupee, which fell from 85.6 to 87.6 against the U.S. Dollar (2.4% drop), combined with ongoing uncertainty surrounding U.S.-India trade relations. Whether this trend can reverse by year-end remains to be seen.

Final thoughts

Aside from the turbulence in Indian equities, July was broadly a positive month for GO SAVER.

The diversified funds have made a strong recovery in July and the fixed income and the U.S. equity funds have all gained well since 1 January 2025, each within their respective risk profiles.

However, the global macro picture is far from clear. Further movements in interest rates are expected in Q3 which will impact equity and bond valuations, as discussed in our recent article. We will keep monitoring and reporting these developments each month.

Coming soon

How to transfer between DEWS and GO SAVER? What are the options and implications for companies and employees? We’ll discuss the details in the coming weeks. Don’t miss out! Sign up to our free newsletter and stay tuned!

If you found this article useful, or have questions or comments, do write to us: info@pensionsmonitor.com.

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | GO SAVER | 31 Jul 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 31 Jul 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 13 Aug 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.