Hardly a day goes by without seeing an internet or newspaper ad promoting the UAE Golden Visa. For those who have somehow missed the buzz, here’s a quick overview of what the Golden Visa is all about:

The UAE Golden Visa is a long-term residence visa program designed to attract and retain foreign talent, investors, entrepreneurs, scientists, outstanding students, and professionals by granting them the ability to live, work, or study in the UAE while enjoying a range of exclusive benefits.

Golden Visas are issued for 5 or 10 years and can be easily renewed as long as eligibility criteria is maintained. (For more detailed information please check the official site.)

There are several paths to qualify for a Golden Visa. For example, based on professional qualifications, salary threshold, real estate investment, or by maintaining a qualifying deposit in a UAE bank or investment fund.

So, what does this have to do with EOSB Savings?

Here is where it gets interesting.

One route to qualify for a 10-year visa is to maintain a deposit of two million dirhams in an investment fund accredited in the UAE. The investment must be maintained for at least two years from date of visa issuance to maintain visa validity.

But from our limited enquiries, it appears that this route is less popular than the more straightforward option of placing two million dirhams in a fixed deposit with a local bank.

Furthermore, there are slight variations in the rules across the Emirates. In Dubai, for example, the Golden Visa rules are governed by the General Directorate of Residency and Foreign Affairs (GDRFA), while for the other emirates, the authority is the Federal Authority for Identity, Citizenship, Customs and Port Security (ICP).

Feedback from Amer Centers in Dubai confirms that eligible deposits may also take the form of investment bonds or sukuk. The supporting documentation required is a letter issued in Arabic by the bank of the deposited amount including a remark that the deposit amount will not be disposed of, except after two years. In case the deposit amount is disposed of, then GDRFA should be notified.

This raises an interesting question:

So, could EOSB Savings Funds qualify?

Could investments in EOSB Savings Funds count toward the AED 2 million Golden Visa requirement?

Let’s examine the facts:

- EOSB Savings Funds are registered and regulated in the UAE, under the Securities and Commodities Authority (SCA).

- Some funds invested locally. For instance, Capital Guarantee Funds are typically 100% invested in fixed deposits with local banks and UAE Government-rated bonds. Shariah-compliant versions often place assets in Wakala deposits with local banks.

- Employer contributions paid every month vest immediately in the employee’s name.

- Fund assets are held by a UAE-based custodian bank and cannot be withdrawn unless certain conditions are met.

Given these factors, could a supporting letter from the custodian bank confirming AED 2 million held in the name of the employee, meet the golden visa requirement?

We were not able to obtain an official confirmation to the question and understandably so, as the concept of EOSB savings schemes is still fairly new in the UAE. Moreover, we were told that golden visa applications are assessed by multiple authorities and approval decisions are ultimately made on a case-by-case basis.

However, when such savings schemes become more established, it is not hard to imagine them becoming a viable route for Golden Visa eligibility. “If” this does eventually happen, it would open a new and meaningful pathway for long-term residents to remain in the UAE – for those approaching retirement or simply, working professionals that want to be self-sponsored, and also sponsor their spouse, children, aging parents, or domestic workers under the golden visa rules.

Is the AED 2 million goal realistic?

Of course that depends on a number of factors, including how much you earn, your age, and the investment return of the selected funds. On the surface, reaching a two million dirhams target through employer contributions alone may seem ambitious but let’s not forget AVC’s (Additional Voluntary Contributions). We have discussed this in previous articles, where we highlighted how much more one can save with regular AVCs.

Our view is that the two million dirhams target is not unrealistic for people earning perhaps around USD 100,000 a year and who save diligently.

Some families may even consider pooling savings under one name. Since a Golden Visa holder can sponsor their spouse, combining savings could help reach the target faster.

EOSB Savings beats Insurance, again

We at Pensions Monitor find it interesting to note that according to our reading of the situation – “whole-of-life” insurance plans are unlikely to qualify towards the two million dirhams goal. (If you have a different view, please write to us: info@pensionsmonitor.com).

That’s one more reason why EOSB Savings Schemes may be a better fit than insurance-based savings products, which often come with higher fees and less flexibility as we discussed in an earlier article.

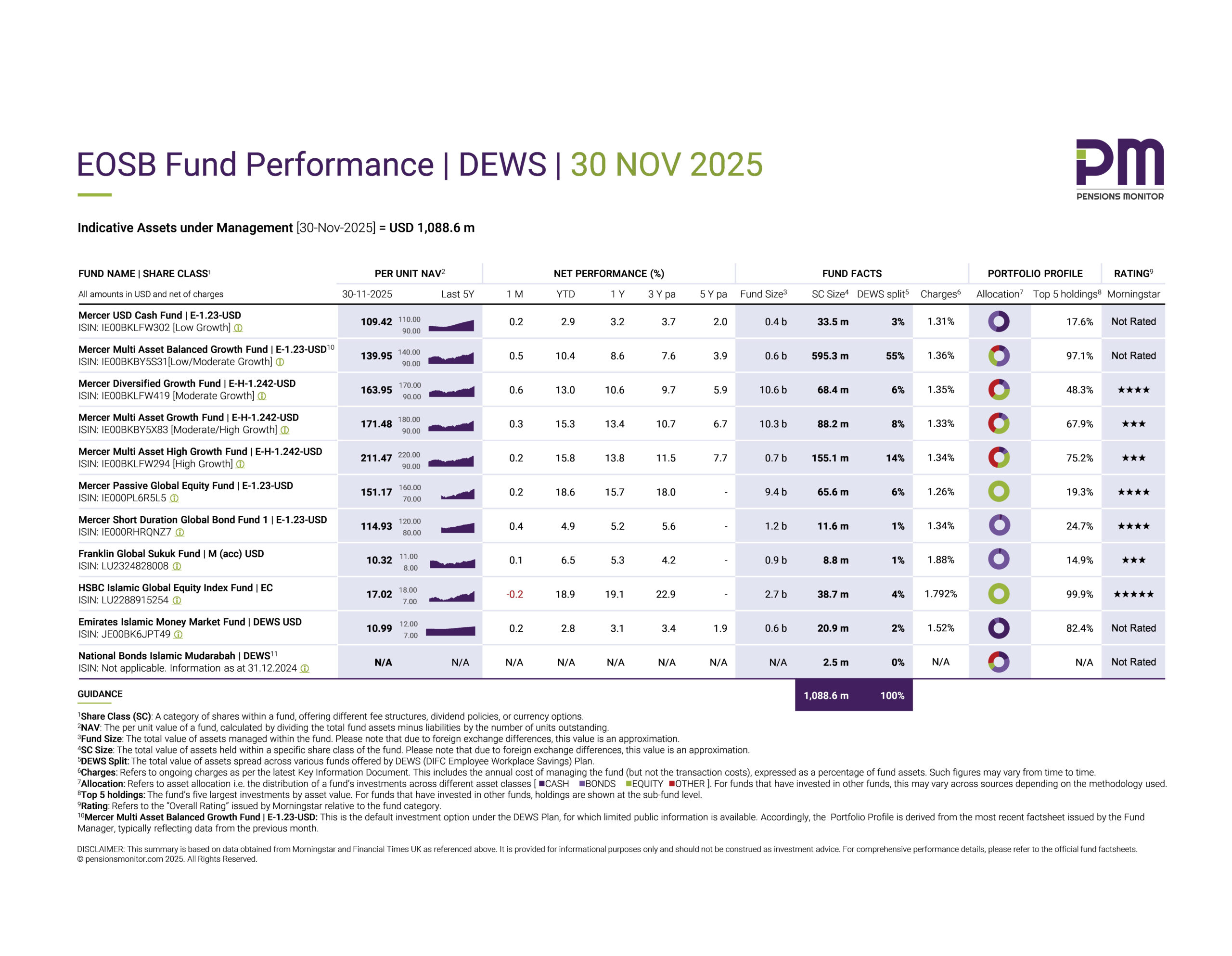

What about the DIFC’s DEWS and GO SAVER?

The final question to ask in this context is what about the DIFC’s EOSB Savings Plans?

While the Golden Visa rule refers to an “investment fund accredited in the UAE,” the funds offered under the DIFC EOSB Savings Scheme are mostly domiciled abroad (e.g., Luxembourg or Ireland).

However, both plans offer some locally-linked funds like the Mashreq Al Islami Income Fund (GO SAVER) and the Emirates Islamic Money Market Fund (DEWS) and the National Bonds Islamic Mudarabah (DEWS), though not all of these are fully registered or domiciled within the UAE.

That said, we have seen the Golden Visa rules evolve regularly since its introduction in May 2019. So, it’s not inconceivable that further clarity, or even reforms, may make EOSB savings more eligible for golden visas over time.

A strategic opportunity?

If the UAE were to explicitly recognise EOSB funds as qualifying investments for the Golden Visa, it could serve multiple policy objectives:

a) Promote and strengthen confidence in the national EOSB Savings Scheme;

b) Support the development of local capital markets; and

c) Encourage expatriates to stay longer in the UAE.

A single policy decision with favourable outcomes for all stakeholders.

But until then, EOSB savers can always cash out their savings after leaving employment, and re-invest the proceeds into qualifying fixed deposits – an already established route to the coveted UAE Golden Visa. That said, don’t just take our word for it. Always consult the relevant regulatory authority to understand the criteria applicable to your specific case.

As always, Pensions Monitor is at the forefront of EOSB savings research, helping employers, employees, and industry participants stay on top of this evolving market.

Sign up to our free newsletter so you don’t miss out!

Cover image source: Amer Center, Dubai