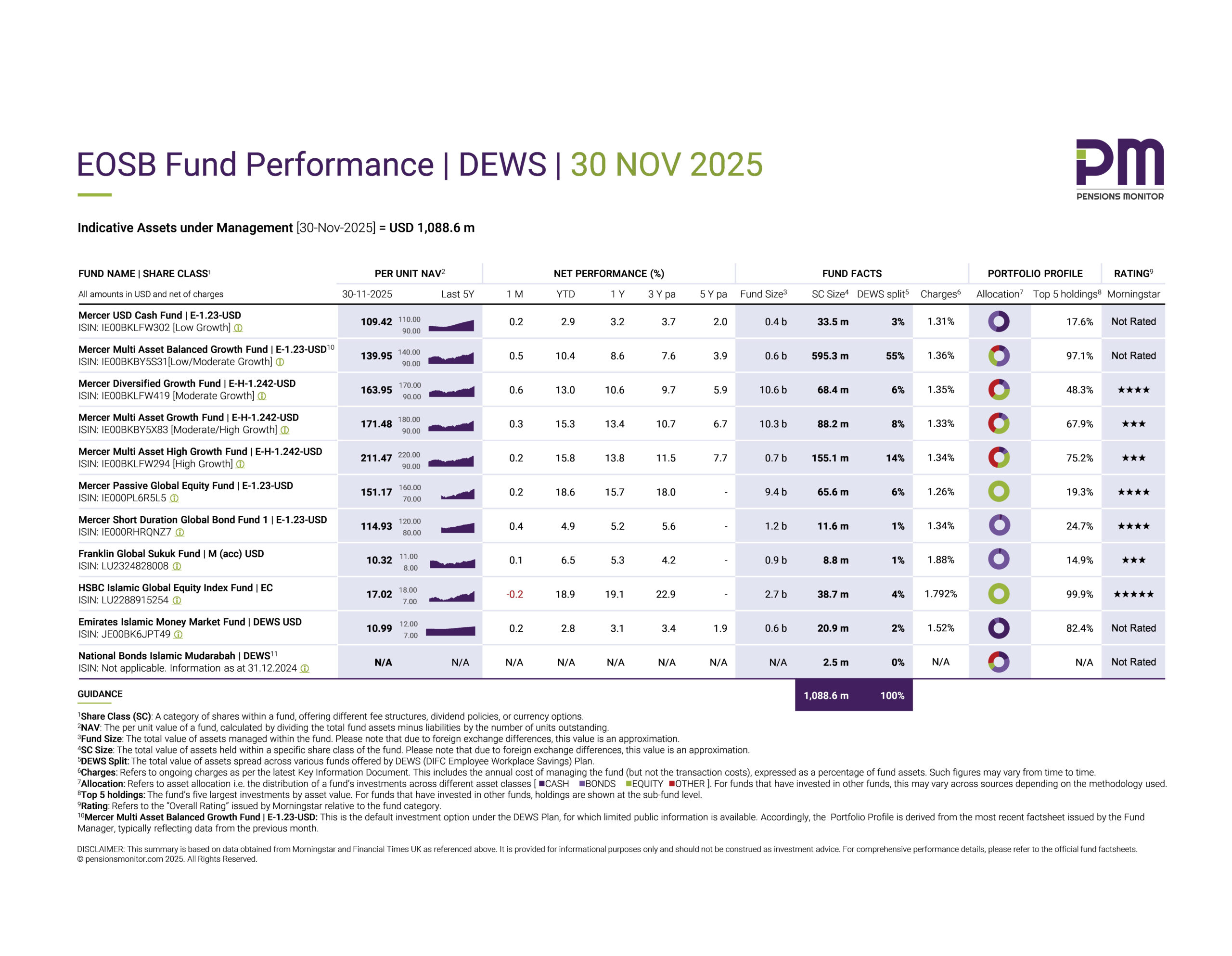

The fund line-up by Ghaf Benefits represents the broadest range of End-of-Service Benefits investment options currently available in the UAE.

This third quarter, we’ve seen a strong pick up in the EOSB savings market in the UAE. Many more companies have been enquiring about the UAE EOSB Savings Scheme and the approved EOSB fund managers have also become much more forthcoming with information. Just last month, we reported that National Bonds became the first to publish the Master Prospectus of its EOSB Umbrella Fund.

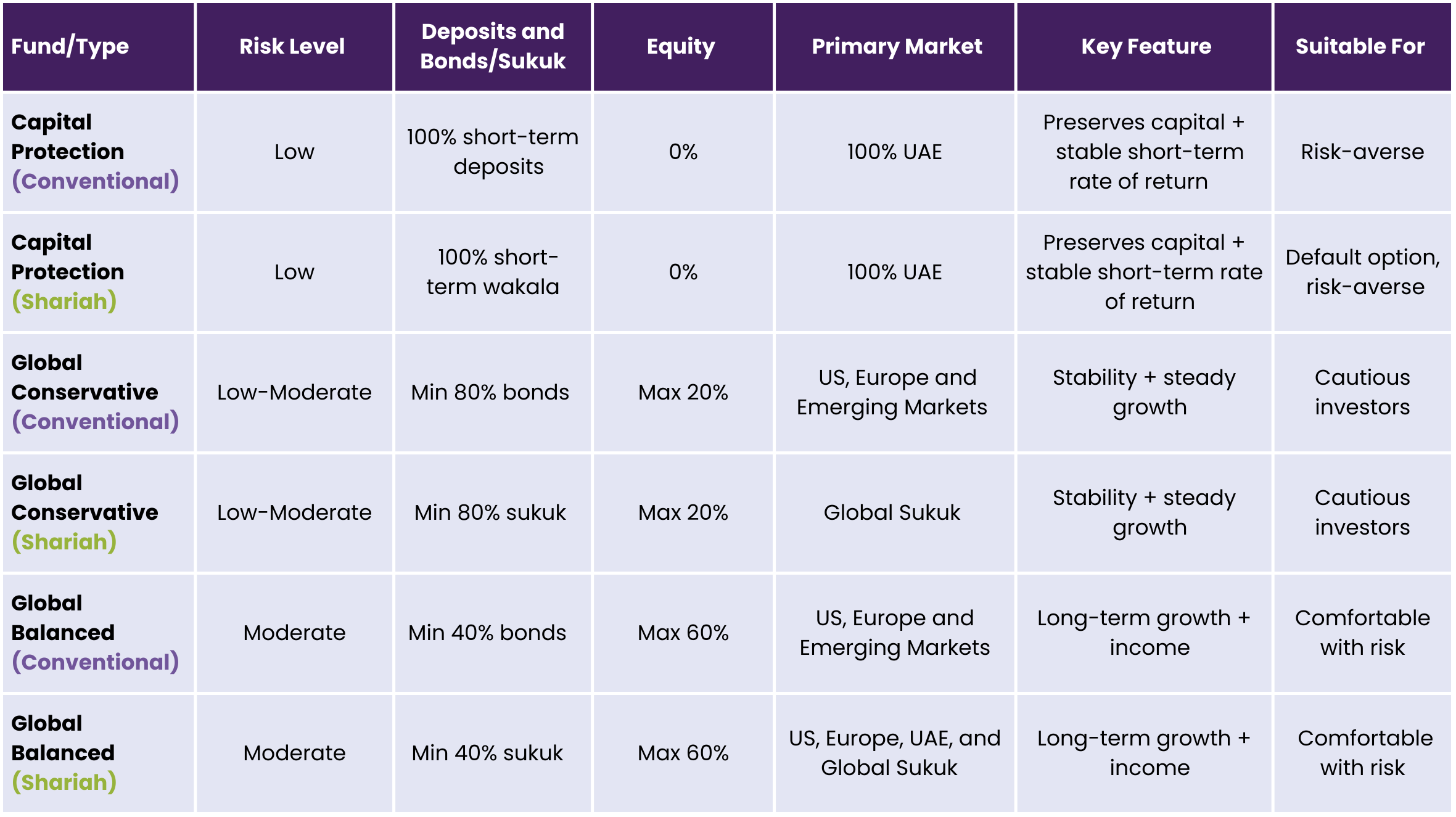

Now, Ghaf Benefits, the alternative EOSB solution offered by Lunate Capital LLC, has released the key features of its six EOSB funds. Lunate/Ghaf Benefits is the only approved EOSB fund manager that launched risk-based funds alongside the Capital Protection Funds in January this year.

Here are the key points to note for each fund family:

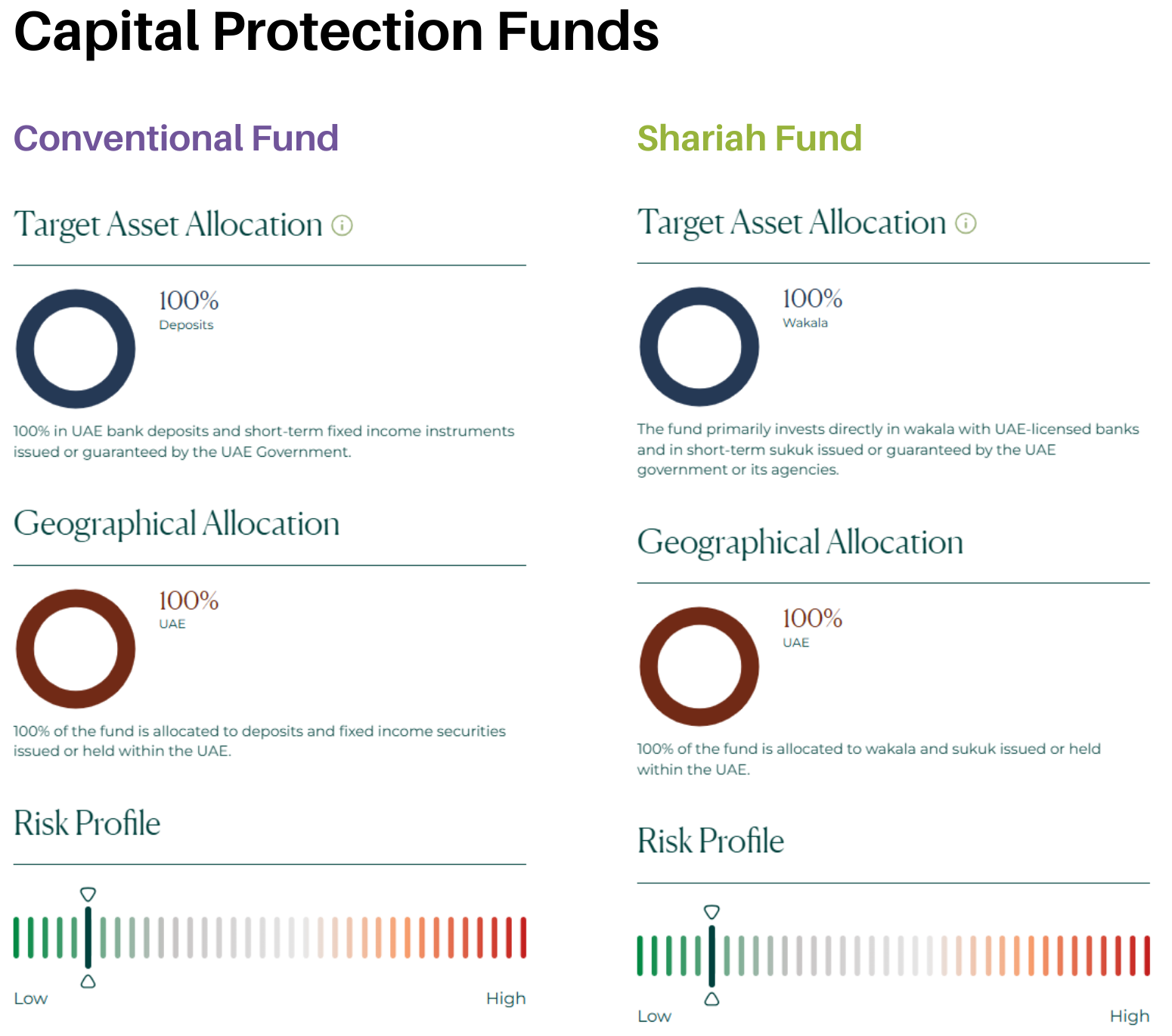

Capital Protection – Conventional Fund and Shariah Fund

Purpose: Preserve capital + stable short-term returns.

How they invest: UAE bank deposits/wakala, short-term UAE government bonds/sukuk.

- 100% of the fund is invested in the UAE.

- No exposure to long-term interest rate or credit risks (average maturity capped at 180 days and maximum maturity is 397 days).

- At least 10% of the fund will be available as cash or near-cash every week. This ensures the fund can handle redemptions quickly without trouble.

- Not more than 10% will be invested into a single security to reduce concentration risk.

In short, these two funds are safe, liquid and sufficiently diversified and is best suited for employees who prefer investment security over risk. The Shariah Fund is also the default investment fund when employees don’t select an investment option or for those that do not qualify as a “skilled worker”.

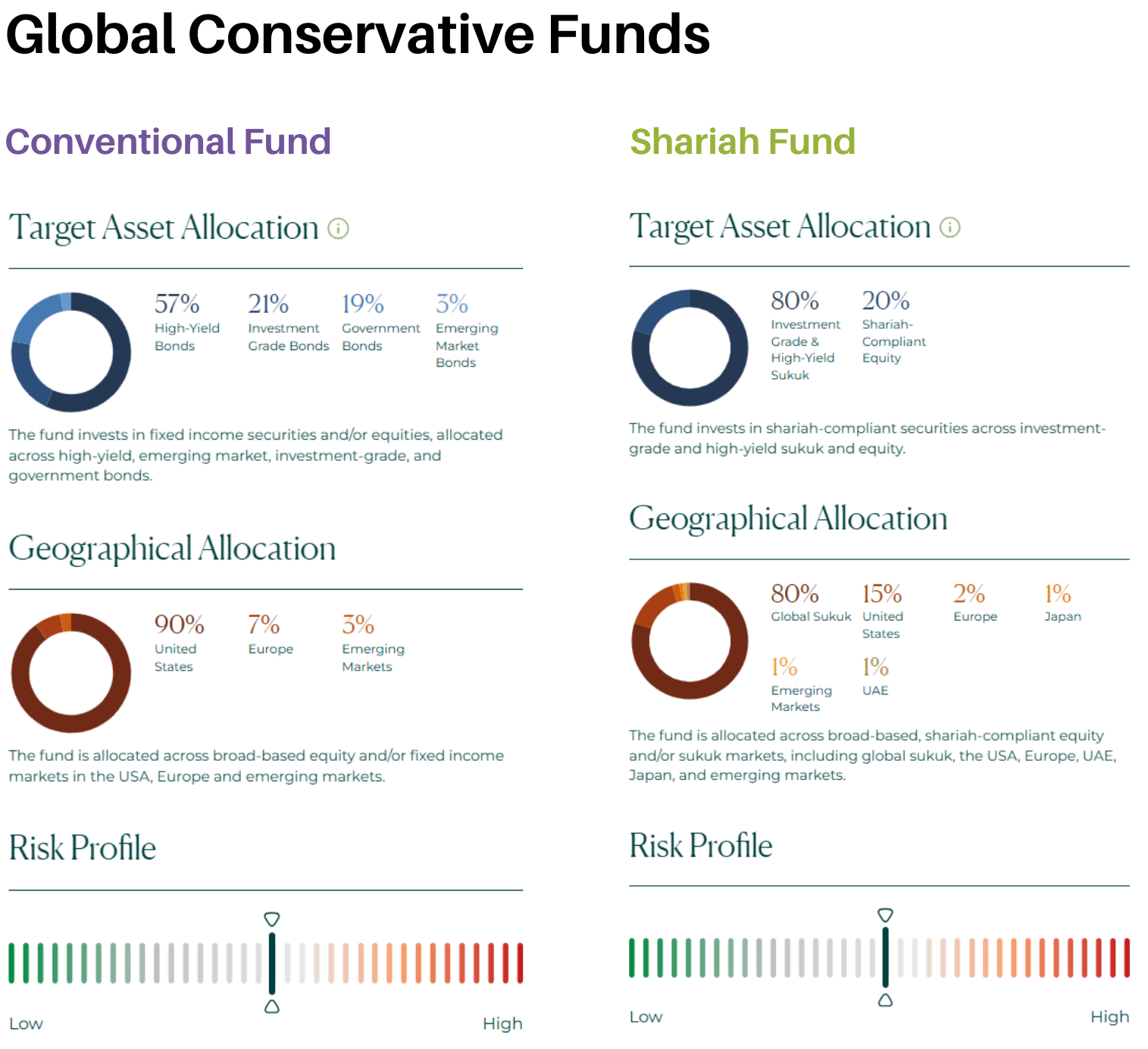

Global Conservative – Conventional Fund and Shariah Fund

Purpose: Steady income + some growth.

How they invest: Mainly global bonds/sukuk (government, corporate bonds), flexibility to invest up to 20% in global equities.

- Actively managed funds that spread investments widely across multiple regions and sectors to reduce risk: Bonds/Sukuk and equities.

- The Conventional Fund is tilted toward US bonds, whereas the Shariah Fund is concentrated in global sukuk and has some equity exposure.

- Most of the investments are in bonds/sukuk which are considered low to medium risk, giving stability and steady returns.

- A small portion can be strategically allocated to equities, which are considered higher risk/higher return, to add some growth potential.

In short, these two funds are designed to generate steady income with a modest scope for growth. They are best suited for cautious investors who want stability with just a touch of upside.

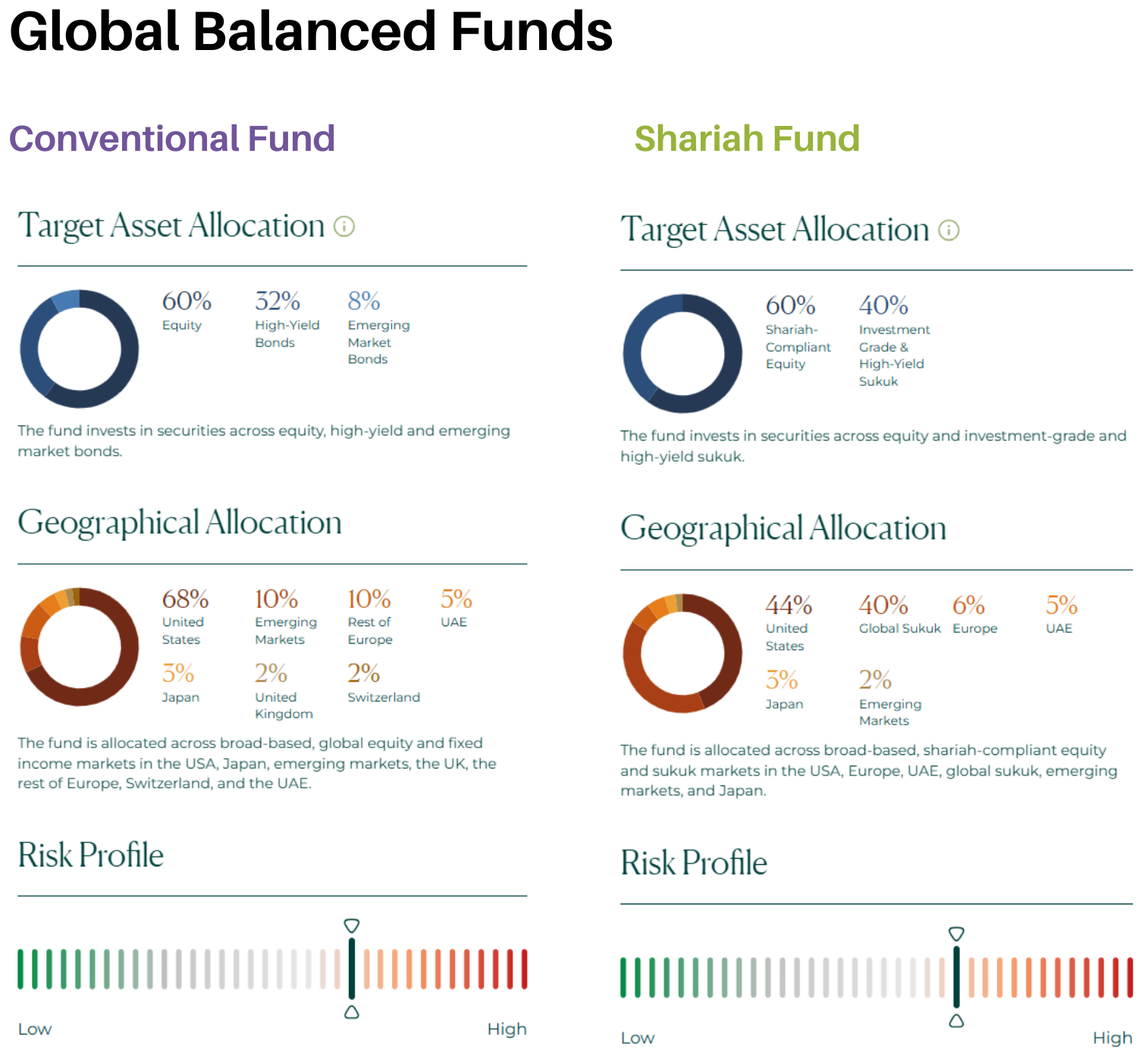

Global Balanced – Conventional Fund and Shariah Fund

Purpose: Long-term growth + income.

How they invest: Roughly 60% global equities, 40% global bonds/sukuk.

- Actively managed funds to spread investments widely across multiple regions and sectors: Bonds/Sukuk and equities.

- The Conventional Fund is primarily US-centric which means performance will track closely with US equity and bond markets. Diversification outside the US exists but is secondary. The Shariah Fund has a more balanced spread regionally, between US and global sukuk markets which is predominantly in the GCC and Southeast Asia.

- A much larger allocation to equity (up to 60%), meaning higher growth potential but also higher risk.

- This fund prioritizes growth compared to the Global Conservative Funds, with only 40% allocated to bonds/sukuk.

In short, these two funds are growth-oriented, but not aggressive and are best suited for employees comfortable with more risk and are aiming for higher returns over the long run.

Summary of key features

All six funds are registered in the UAE with UAE dirham as the base currency. The funds are regulated by the Securities and Commodities Authority (SCA) and managed by Lunate. Please note that the fund prospectus or detailed term sheets have not yet been published, which means information on fund fees is not yet publicly available.

Our thoughts

The recent disclosure by Ghaf Benefits of their EOSB fund offerings is a positive step for the UAE savings market and will likely encourage the other approved fund managers to follow suit soon.

With Ghaf Benefits/Lunate currently being the only approved EOSB fund manager offering risk-based funds, companies with a larger proportion of skilled employees may find these investment options particularly appealing.

Many HR professionals we’ve spoken to are waiting to see the returns EOSB funds generate before considering a switch from the traditional gratuity system. At present, no performance data has been published by any of the approved EOSB fund managers, but we expect the first set of fund factsheets to be released by Q1 2026.

As more information becomes publicly available, particularly on fund performance (and fees), we expect to see employer uptake increase. Pensions Monitor will continue to track developments and report updates to our subscribers as they happen. If you haven’t already, please subscribe to our free newsletter to stay informed.