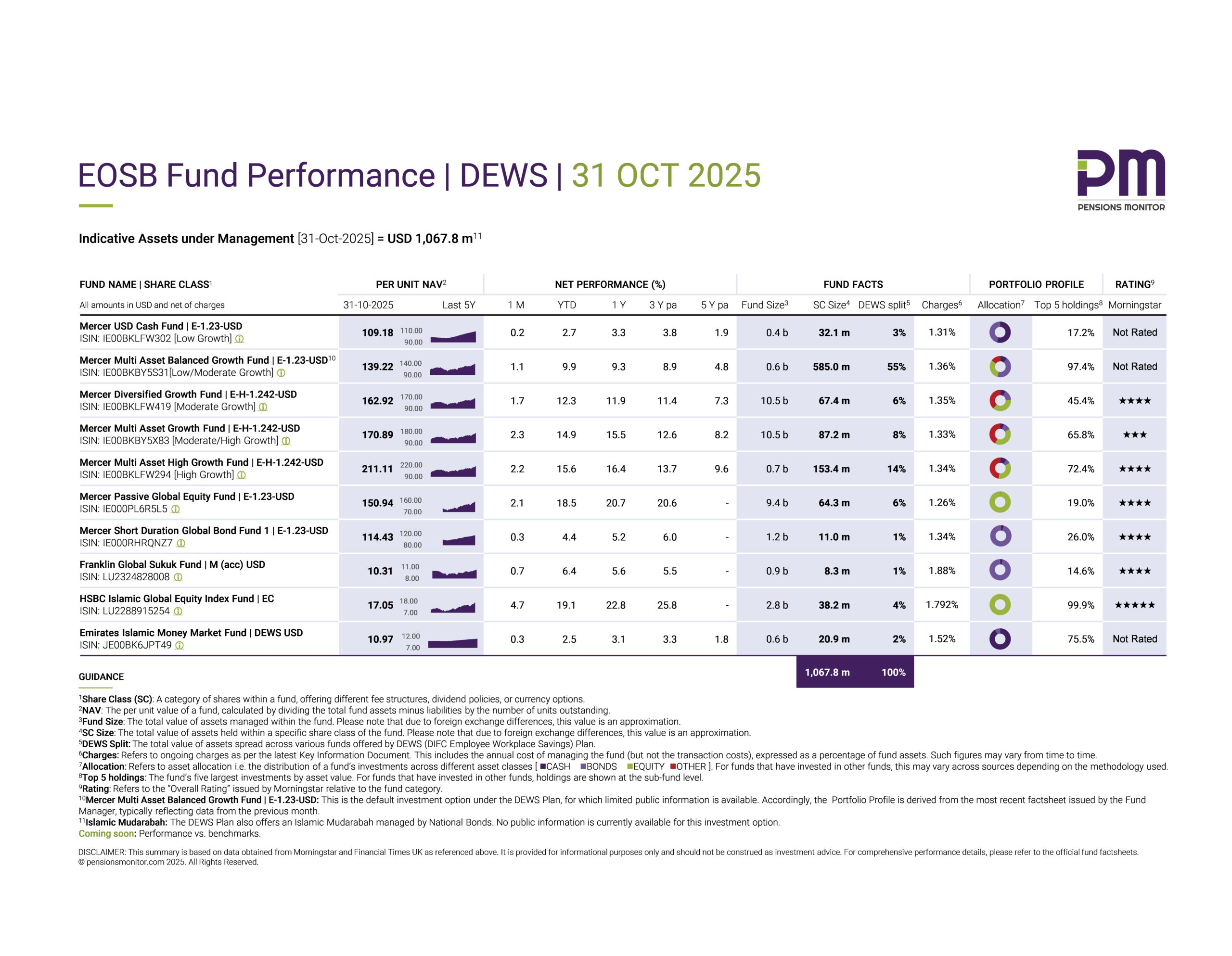

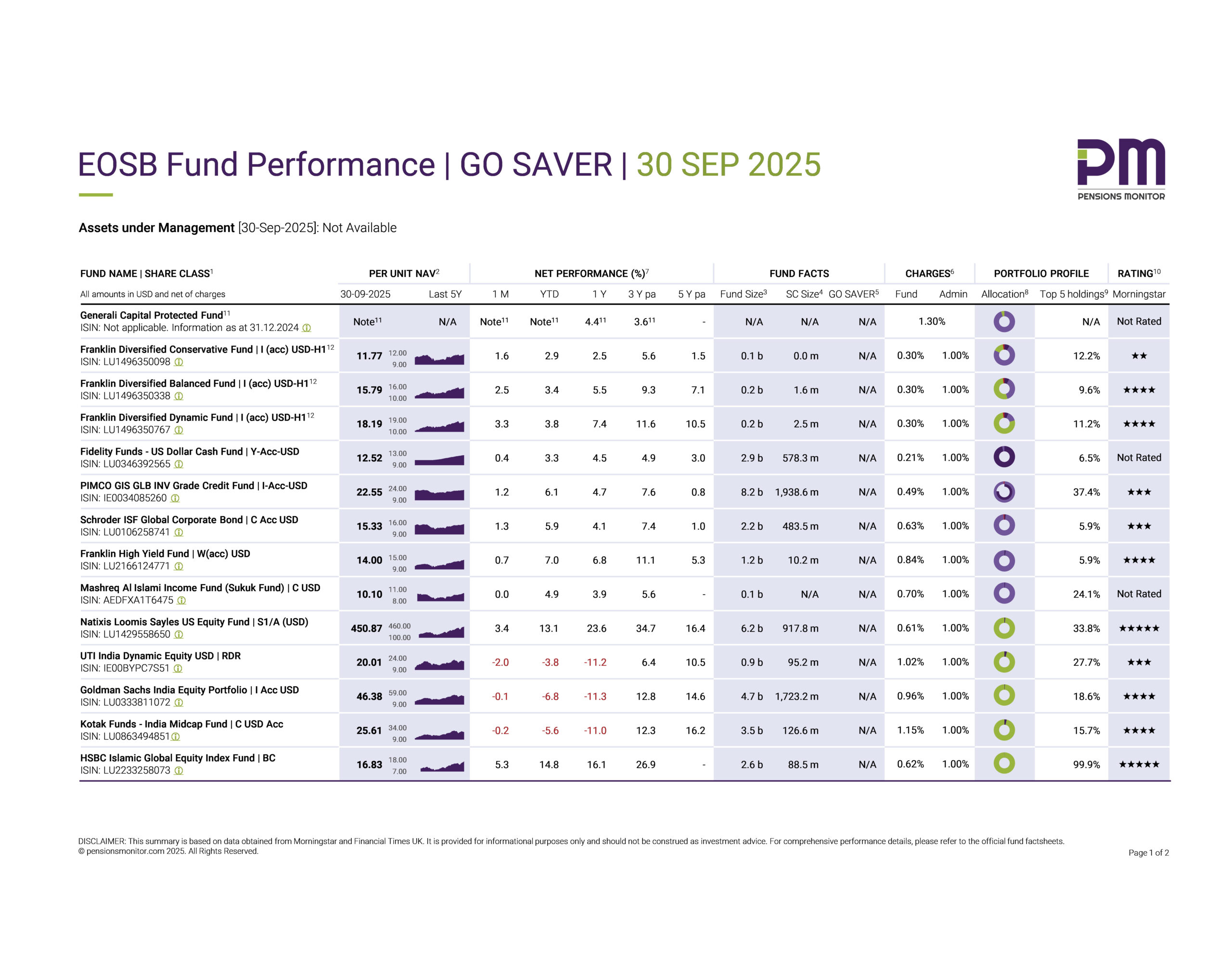

EOSB Fund Performance | GO SAVER | 30 SEP 2025

Following our performance review of DEWS for the month of September, it’s time to look at how the GO SAVER funds have fared. GO SAVER is the second official End of Service Benefits (EOSB) Savings Plan in the Dubai International Financial Centre (DIFC).

For our new readers, it’s worth noting that DIFC employers can enrol their employees in either Plan, DEWS or GO SAVER – or both – depending on what best suits their workforce. We recently outlined the process for transferring between DEWS and GO SAVER, which you can find here.

Before we dive into fund performance, here’s a quiz question for our dear readers:

Which major asset class has scored the highest return this year?

Was it stocks (equities), bonds, or money market investments – or perhaps a commodity or an alternative asset?

If you guessed stocks, you’re wrong.

The standout winner this year so far has been a commodity, gold. At the beginning of the year an ounce of gold traded around USD 2,623, and today it’s about USD 4,247, an increase of 62%, beating hands-down every other mainstream asset class.

The balanced and diversified funds under DEWS and GO SAVER both have allocations to commodities and alternatives. However, how much of that exposure sits in gold is not disclosed. Perhaps, it’s something their respective investment advisers will revisit when reviewing the fund line-up for next year!

For now, let’s look at the GO SAVER funds.

👉 Click here to download the dashboard.

Fixed Income Funds

The fixed-income (or bond-based) funds under GO SAVER have continued their positive trend:

- PIMCO GIS GLB Inv Grade scored +1.2% in September, and +6.1% Year-to-Date (YTD)

- Schroder ISF Global Corporate Bonds +1.3% in September, and +5.9% YTD

- Franklin High Yield Fund +0.7% in September, and +7.0% YTD

- Mashreq Al Islami Sukuk Fund, stayed flat in September with YTD +4.9%

Franklin Templeton’s Diversified Funds

The series of Franklin Diversified Funds have delivered a stronger September, scoring +1.6% (the Conservative fund), +2.5% (for the Balanced fund) and +3.3 (for the Dynamic fund).

How does this compare with the balanced funds under DEWS?

Pensions Monitor will soon publish a comparative analysis between the two plans, comparing funds by risk class. Stay tuned!

The Indian-Equity Funds

Next, let’s turn our attention to GO SAVER’s Indian fund lineup.

All three Indian funds extended their losing streak through September, closing the month with further declines:

- UTI India Dynamic Equity: -2.0% for September, and -3.8% YTD

- Goldman Sachs India Equity Portfolio: -0.1% for September, and -6.8% YTD

- Kotak Funds India Midcap: -0.2% for September, and -5.6% YTD

With one quarter left in the year, hopes remain that the INR and the Indian equity funds, will be able to reverse course.

Equity-based funds

Apart from the three Indian equity funds, GO SAVER offers two more equity-based funds – a conventional fund and a Shariah equity fund – both of which are heavily invested in US stocks.

The Natixis Loomis Sayles US Equity Fund, has been performing well, scoring +3.4% in September alone, bringing the YTD performance to +13.1%.

This impressive result was topped by the HSBC Islamic Global Equity Index fund, which scored +5.3% in September, bringing the YTD return to +14.8%.

Closing thoughts

Overall, September was a good month for GO SAVER – most funds ended on a positive note, except for the Indian equity funds, which continued to struggle.

As for the Generali Capital Protected Fund which is the default investment option under GO SAVER, there’s no update yet on performance for 2025, but we’ll report on this as soon as the information becomes available.

We’re now in the final stretch of the year – let’s see what the last quarter has in store. What’s your bet on how 2025 will wrap up?

Stay tuned and sign up for our free newsletter for the latest on all EOSB Plans in the UAE. If you found this article useful, or have questions or comments, do write to us: info@pensionsmonitor.com.

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | GO SAVER | 30 Sep 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 30 Sep 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 23 Oct 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.