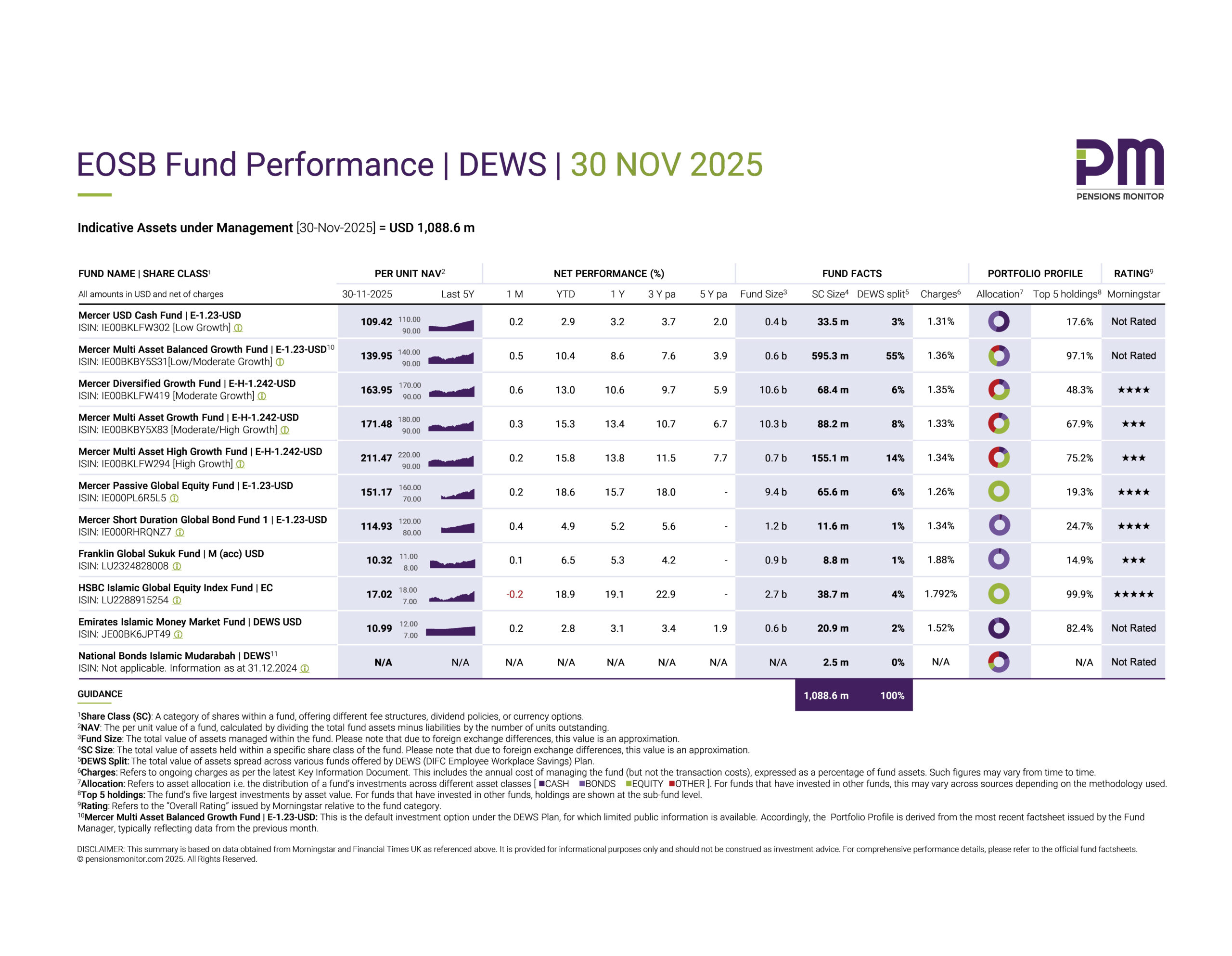

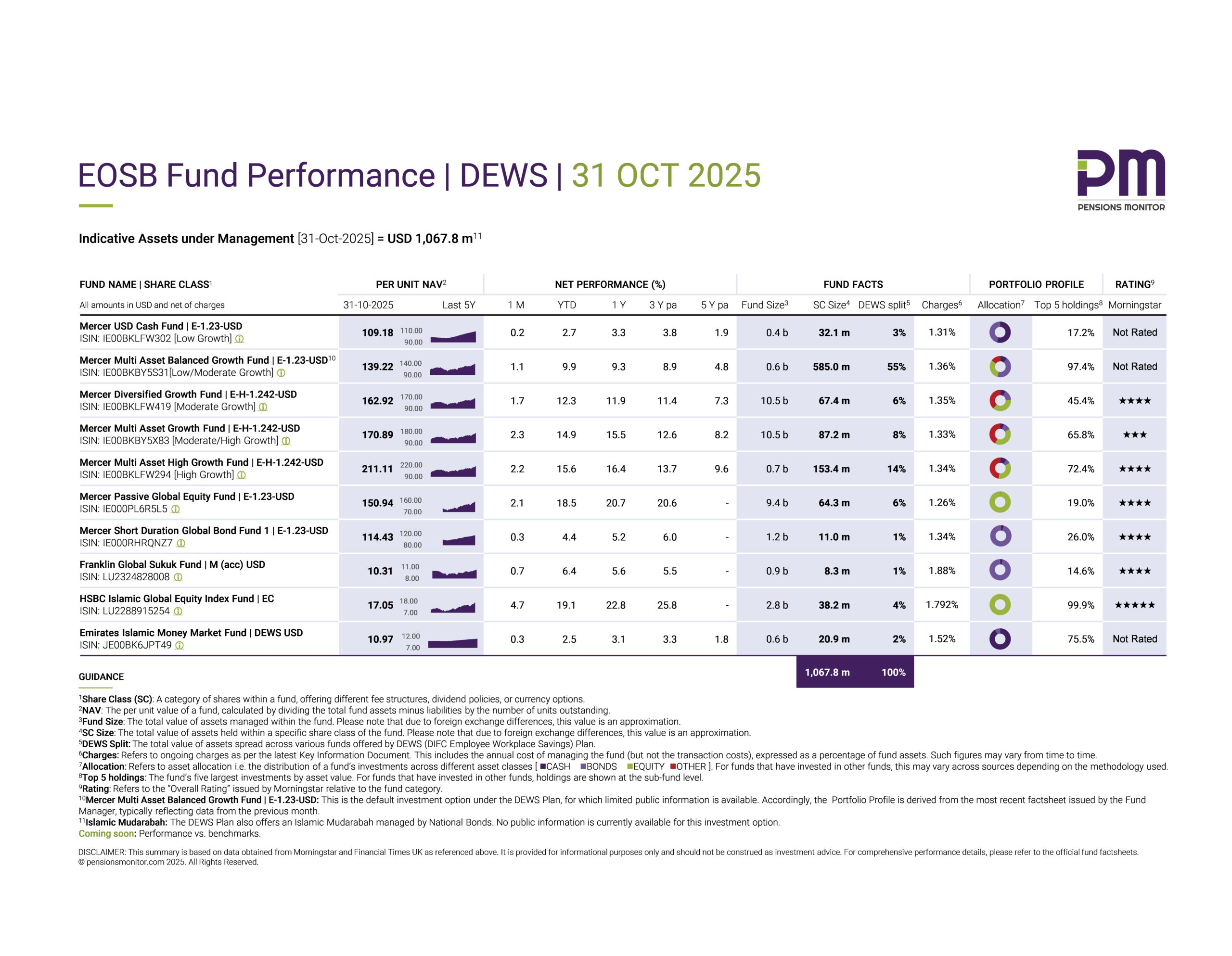

EOSB Fund Performance | DEWS | 31 OCT 2025

Like every month, we’re pleased to share the highlights of the DEWS funds’ performance for October.

As mentioned in previous articles, these funds are designed to be held over several years; so monthly ups and downs are less relevant in isolation. That said, tracking short-term performance helps us spot trends that may be useful and informative for DEWS plan participants.

👉 Click here to download the dashboard.

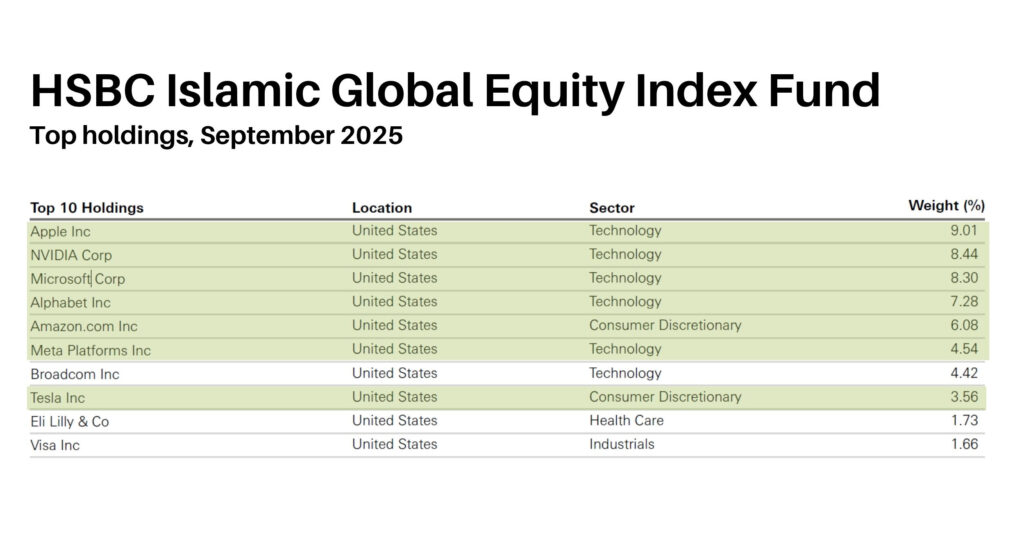

The Magnificent 7

A lot is being written about the so-called “Magnificent 7” stocks. These are the seven companies that have driven much of the global equity market’s growth (and hype) in recent years.

They are: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta (META), and Tesla (TSLA).

You might wonder, what does that have to do with DEWS?

Quite a bit, actually. Many of the funds available under DEWS invest in these companies to varying degrees. Let’s take the HSBC Islamic Global Equity Index Fund as an example (this fund is also available under the GO SAVER Plan).

As the fund’s top holdings show, several of the Magnificent 7 stocks feature prominently and together represent around 47% of the total fund value.

That means when these stocks rally, the fund performs strongly and, of course, the reverse is also true.

We saw that clearly in October. The HSBC Islamic Global Equity Fund rose 4.7%, bringing its year-to-date (YTD) performance to an impressive +19.1%. With that result, the HSBC fund has edged ahead of the Mercer Passive Global Equity Fund, which gained 2.1% in October and stands at +18.5% YTD.

Which fund will take the crown for 2025? We’ll find out in January!

Balanced Funds

The four Mercer balanced funds performed well too: steady gains, though not as high as the equity funds which carry greater volatility.

For instance, the Mercer Multi-Asset Balanced Growth Fund, which is the DEWS default option, returned +1.1% in October, bringing its YTD gain to +9.9%.

The other balanced Mercer funds also fared very well:

- Mercer Diversified Growth Fund: +12.3% YTD

- Mercer Multi-Asset Growth Fund: +14.9% YTD

- Mercer Multi-Asset High Growth Fund: +15.6% YTD

There is one more balanced investment option offered under DEWS which is Shariah-compliant. This is the National Bonds Islamic Mudarabah that was introduced to the DEWS panel in May 2024 for which there is still no public information (see here for further details). We look forward to share more information on the performance of this investment option as soon as it becomes available.

Bond-based funds

Next, let’s have a look at the funds that invest mostly in bonds. Under DEWS, we have two such funds:

- Mercer Short Duration Global Bond Fund: +0.3% in October, +4.4% YTD

- Franklin Global Sukuk Fund: +0.7% in October, +6.4% YTD

The money market funds meanwhile continue to deliver modest, stable returns:

- Mercer USD Cash Fund: +0.2% in October, +2.7% YTD

- Emirates Islamic Money Market Fund: +0.3% in October, +2.5% YTD

Our thoughts

With 10 months of the year behind us, it’s clear to see that equity funds, particularly those with large exposure to the “Magnificent 7”, have had a stellar year.

The key question now is whether that rally is sustainable, or if a market correction could be around the corner, as some analysts suggest.

If such a correction is forthcoming, diversification across many stocks, and across other asset classes may be a wise move and can help portfolios absorb any potential shocks.

To be continued!

Coming up next

Our review of the performance of the rival plan, GO SAVER.

Subscribe to our free newsletter for the latest on EOSB in the UAE.

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | DEWS | 31 Oct 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 31 Oct 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 13 Nov 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.