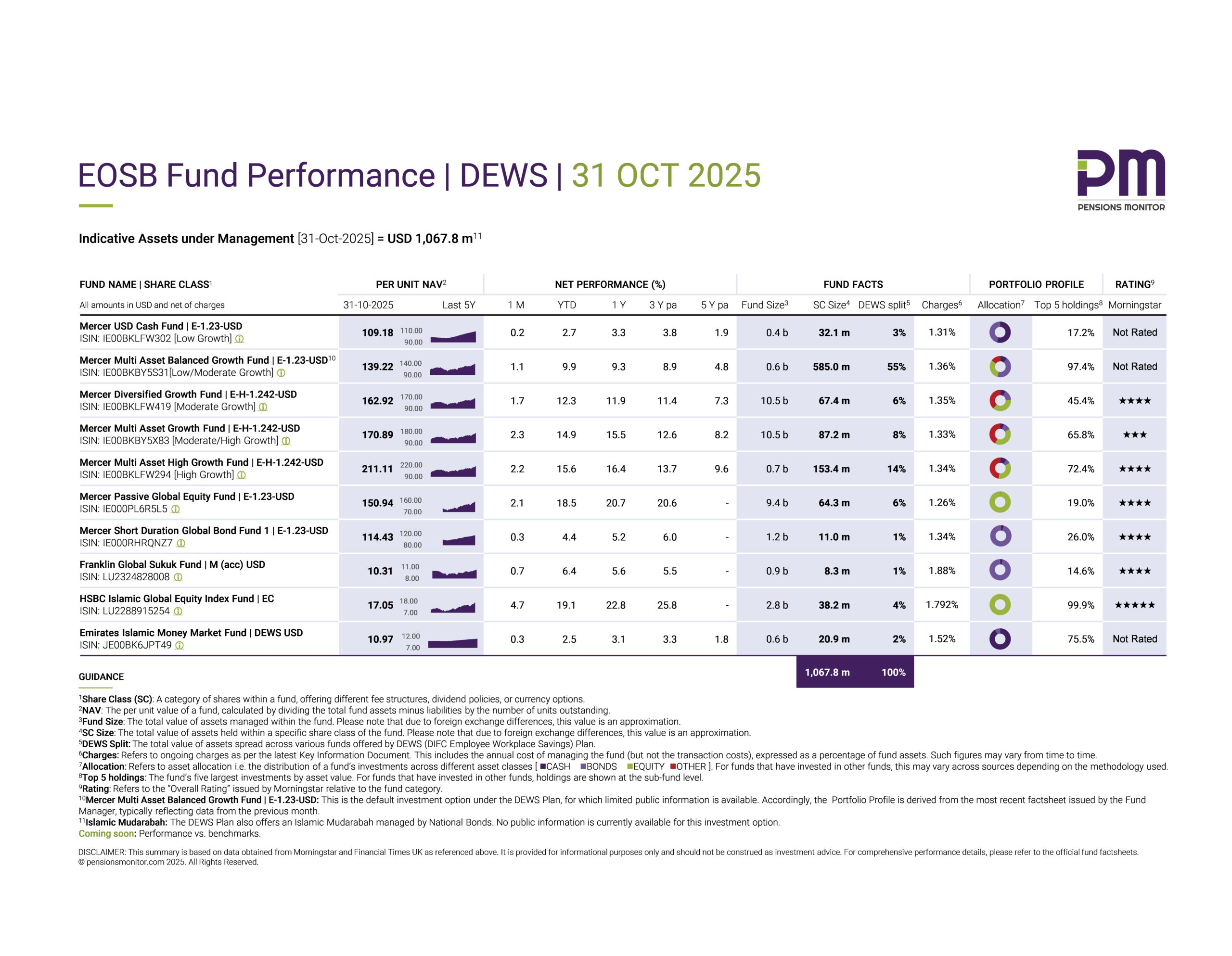

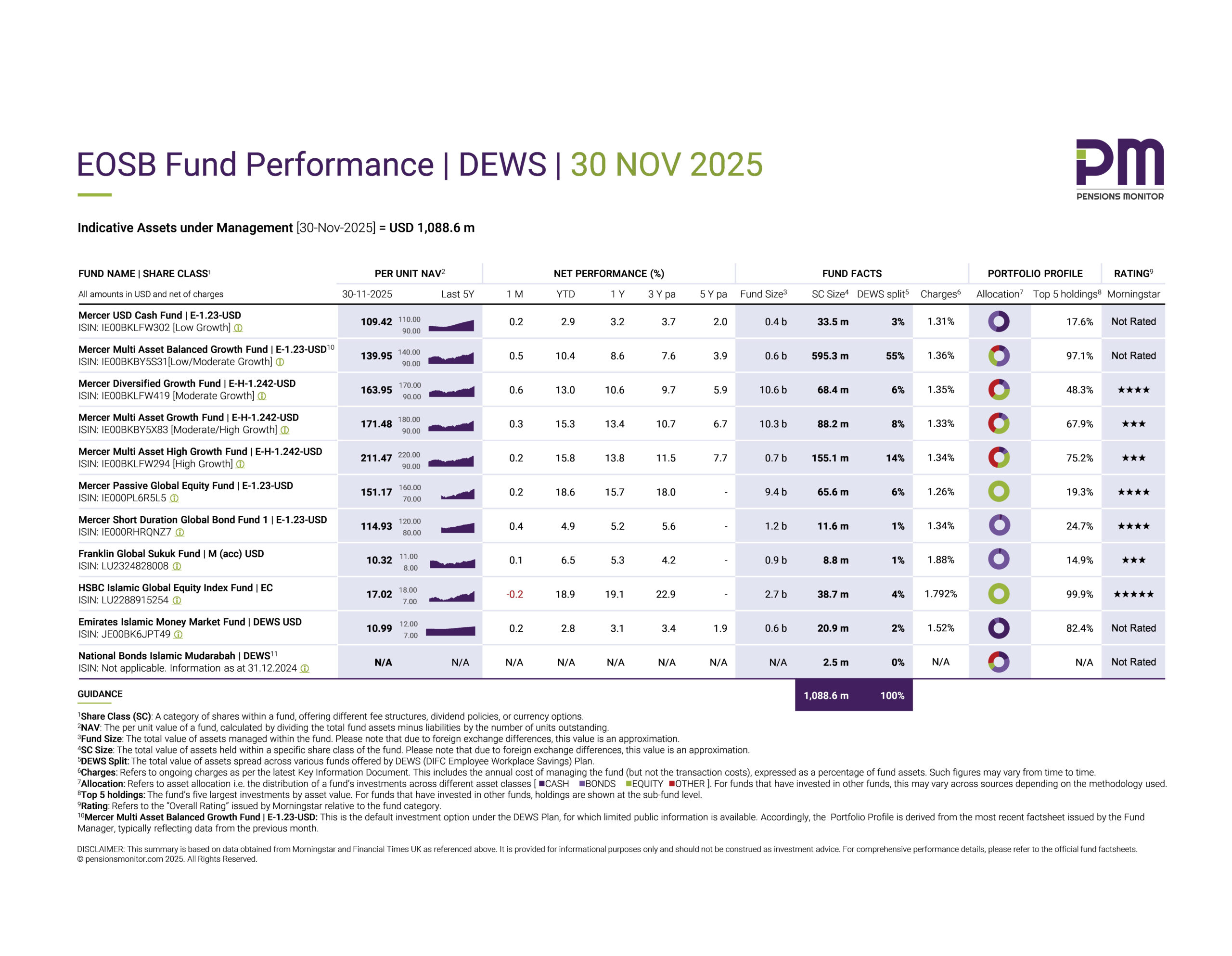

EOSB Fund Performance | DEWS | 30 NOV 2025

As we do every month, it’s time to share the highlights of the DEWS funds’ performance for the month of November. For our new subscribers, DEWS is one of the two official End-of-Service Benefits (EOSB) Savings Plans in the Dubai International Financial Centre (DIFC). Our monthly review of the other official plan in the DIFC (GO SAVER) will follow in a separate article.

Before we get into the details, please be reminded that EOSB Savings Schemes are designed to be held over several years. As such, the monthly ups and downs are less relevant. Nevertheless, tracking performance and market movements may be helpful and informative for plan participants.

👉 Click here to download the dashboard.

Equity Funds

DEWS offers two equity funds. Both have been relatively flat in November. The HSBC Islamic Global Equity fund has lost 0.2%, whilst the Mercer Passive Global Equity Fund has gained 0.2%. Both funds show a truly impressive “Year to date” (YTD) performance, with 18.9% and 18.6%, respectively. While we wait for what December brings, it’s already clear to see that 2025 has been a phenomenal year for equity investments.

Balanced Funds

The four Mercer balanced funds have performed very well too, and continued to notch up gains in November.

For instance, the Mercer Multi Asset Balanced Growth Fund, which is the DEWS default fund, scored 0.5% in November, bringing the total gain for this year to 10.4%. The Mercer Diversified Growth Fund is now at 13.0% YTD, the Mercer Multi-Asset Growth fund stands at 15.3%, and the Mercer Multi Asset High Growth Fund at 15.8%.

There is one more balanced investment option offered under DEWS. This is the National Bonds Islamic Mudarabah that was introduced to the DEWS panel in May 2024 for which there is still no public information (see here for further details). We look forward to share more information on the performance of this investment option as soon as it becomes available.

Bond-based funds

Next, let’s have a look at the funds that invest in primarily in bonds.

In the DEWS panel, there are two such funds:

- Mercer Short Duration Global Bond Fund, with 4.9% YTD, after having booked a return of 0.4% in November.

- Franklin Global Sukuk Fund: This fund did better with a 6.5% YTD gain, with a small gain of 0.1% in November.

The money market funds meanwhile have booked some modest gains too:

Both, the Mercer USD Cash Fund and Emirates Islamic Money Market Fund gained 0.2% in November bringing the YTD performance to 2.9% and 2.8%, respectively.

Our thoughts

Overall, November was a positive month for DEWS savers. All funds delivered gains, with just one equity fund ending the month slightly lower. YTD performance across the DEWS range remains solid.

We are still awaiting performance data for the National Bonds Islamic Mudarabah investment option and will share an update as soon as this becomes available.

We are now in the final month of the year, and it’s clear that equity funds (particularly those with significant exposure to the “Magnificent 7” stocks) have performed exceptionally well in 2025. That said, higher return potential inevitably comes with higher volatility. Today, around 10% of DEWS savings sit in the two equity funds.

For savers seeking a more balanced approach or lower exposure to market swings, DEWS offers a broad range of options, including the Mercer balanced funds and bond funds.

With the year drawing to a close, this may be a timely moment for savers to pause and ask a simple but important question: How much risk and short-term volatility am I truly comfortable with?

Coming up next

Our review of the performance of the rival plan, GO SAVER.

Subscribe to our free newsletter for the latest on EOSB in the UAE.

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | DEWS | 30 Nov 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 30 Nov 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 17 Dec 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.