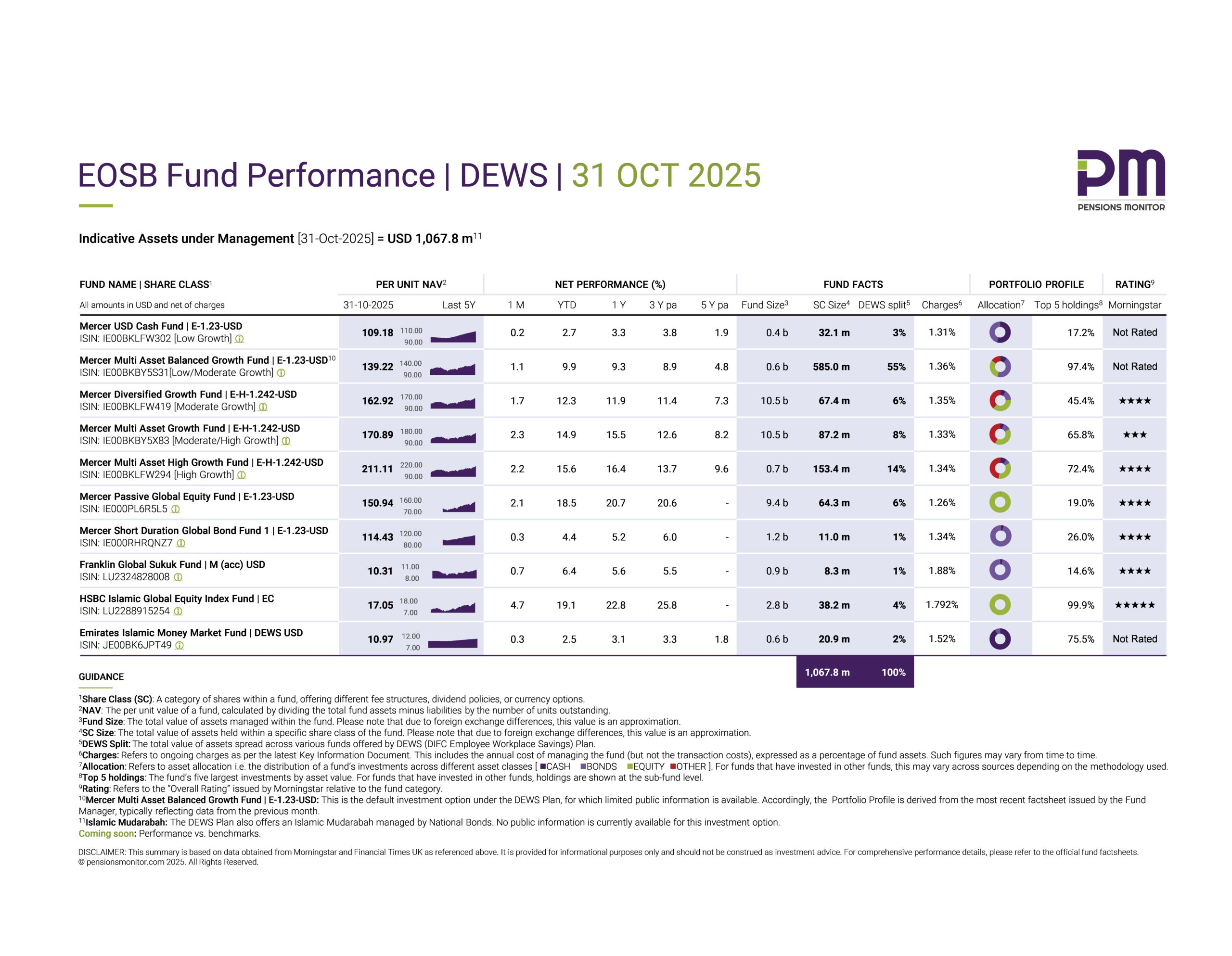

EOSB Fund Performance | DEWS | 30 JUN 2025

As we do every month, it’s time to review the performance of the DEWS funds. June marks the halfway point of the financial year, so it’s interesting to see how plan members’ savings have fared so far: Did members gain or lose value?

👉 Click here to download the dashboard.

In short: it’s good news. Every single fund offered under DEWS posted a positive year-to-date (YTD) return, meaning that all members saw their savings grow.

As at 30 June 2025, total savings (Assets under Management) in DEWS reached USD 944m, up USD 155m (or 20%) since the end of December 2024, when the pot stood at USD 789m. Of course, this growth has come not only from investment gains, but also from regular EOSB contributions and the entry of new members.

Please note: The dashboard does not include data for the National Bonds Islamic Mudarabah investment option, an additional DEWS offering, as its performance information is not publicly disclosed.

Fund performance YTD 30 June 2025

The top performer is the Mercer Passive Global Equity Fund, with a net gain of 8.6% for the first half of this year.

The default fund (Mercer Multi Asset Balanced Growth Fund) which accounts for the bulk (57%) of all DEWS investments did notably well too, gaining 5.2% net of charges. It is interesting to note that this is a balanced fund and has remained the most popular fund choice over the years.

In contrast, GO SAVER, the DIFC’s second official savings plan offers a capital guarantee fund as the default option which of course, is said to carry close-to-zero risk, and will likely generate a lower net return than the DEWS default. It will be interesting to see if the default of GO SAVER becomes as popular over time. These two default options will be compared and contrasted in a separate article soon. Watch this space!

The other three multi-asset funds offered under DEWS also seem to be popular and have almost consistently accounted for about one-third of investments over the years. The six-month net results are also strong:

- the Mercer Multi Asset High Growth Fund (6.9%);

- the Mercer Multi Asset Growth Fund (6.5%); and

- the Mercer Diversified Growth Fund (5.6%).

The Bond-based and Shariah-Compliant funds, together accounting for ~7% of all DEWS investments and have shown modest YTD gains:

- the Mercer Short Duration Global Bond Fund (2.6%);

- the Franklin Global Sukuk Fund (3.4%);

- the HSBC Islamic Funds Global Equity Index Fund (3.6%); and

- the Emirates NBD Islamic Money Market Fund (1.5%).

However, it’s worth bearing in mind that each fund has a distinct risk and volatility profile. This means that some funds have a tendency to react strongly to general market movements. For example, there are rumours that the Trump administration is looking to increase trade tariffs again – this would negatively impact the equity funds again, as was the case earlier this year.

Bond-based funds on the other hand are much more sensitive to interest rate movements. In short, if interest rates drop, the price of bonds will increase, particularly the price of long-duration bonds. Many Central Banks have already lowered interest rates, and the US Federal Reserve is expected to follow suit soon. This will likely impact the price of the bond funds (with US exposure) positively.

Final thoughts

In short, H1 2025 has been positive for DEWS members. Congratulations to the DEWS team and Mercer, as investment advisor for the strong results so far this year.

That said, market volatility – and political uncertainty – continue, as will interest rate movements. And all of these will influence fund performance going forward.

If you found this article useful, please do share it and don’t forget to sign up for our free newsletter to keep track of the performance of all Employee Savings Schemes in the UAE!

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | DEWS | 30 Jun 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 30 Jun 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 12 Jul 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.