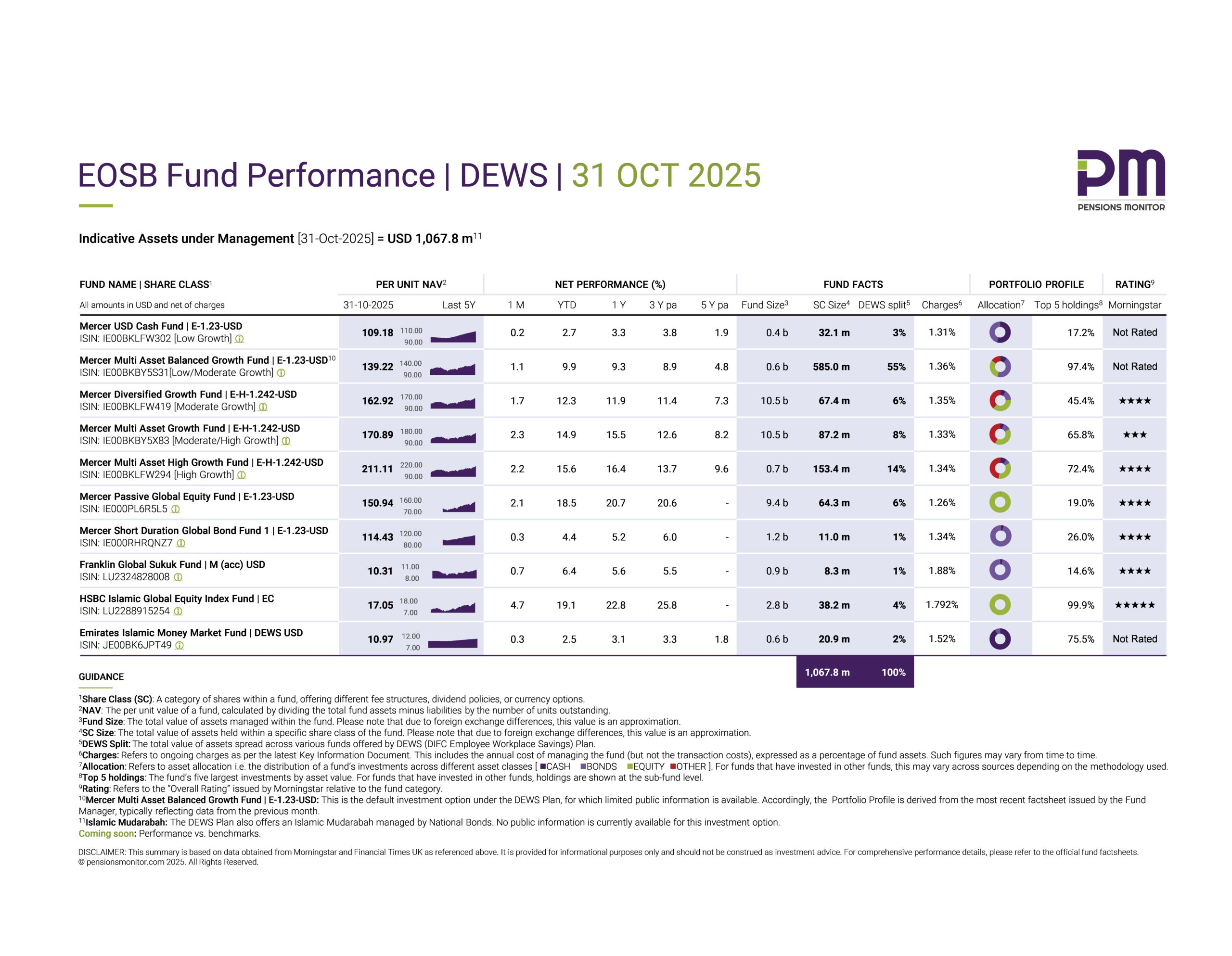

EOSB Fund Performance | DEWS | 31 AUG 2025

Each month, we review the performance of the investment funds available under Dubai International Financial Centre’s two workplace savings plans: DEWS and GO SAVER.

In this article, we’ll look at how DEWS performed in August. Our review of GO SAVER will follow shortly.

👉 Click here to download the dashboard.

Money market funds vs. Risk-based funds. Who gained?

At the safest end of the spectrum, DEWS offers two money market funds. Both have posted steady but modest gains year-to-date:

- Mercer USD Cash Fund: +2.1% YTD

- Emirates Islamic Money Market Fund: +2.0% YTD

By contrast, equity-based funds have again surged ahead:

- Mercer Passive Global Equity Fund: +12.5% YTD (gaining +2.5% in August)

- HSBC Islamic Global Equity Index Fund: +8.1% YTD (gaining +1.9% in August)

Fixed income funds also held their ground, delivering moderate but solid returns:

- Franklin Global Sukuk Fund: +5.0% YTD (gaining +1.0% in August)

- Mercer Short Duration Global Bond Fund: +3.6% YTD (gaining +0.5% in August)

And sitting in the middle of equity-based funds and fixed income funds, are the multi-asset funds that blend equities, bonds, and other assets. These four funds have seen commendable gains in August ranging from 1.5% to 2.0% with YTD gains ranging between 6.9% to 9.7%. Among these is the balanced default option that holds ~56% of all DEWS savings:

- Mercer Multi-Asset Balanced Growth Fund: +6.7% YTD, with a +1.5% boost in August.

So, what does this tell us?

Simply put, the numbers make the picture clear once again:

- Money market funds are safe, but their returns are limited.

- Fixed income or bond-based funds provide higher returns with relatively low risk.

- Equity-heavy funds substantially outperform the above categories, albeit with more volatility.

- Balanced funds, like the DEWS default, land in the middle, offering stability alongside growth potential.

It’s a useful reminder that while money market funds may look attractive for their safety, the returns they generate rarely keep up with inflation and deliver little meaningful long-term growth compared to higher-risk funds .

But of course, markets move in cycles and there will be times when you find “the shoe on the other foot”. When equities correct or crash, money market funds will hold their value or perhaps, even deliver a small return, while higher-risk funds may take a hit.

Nevertheless, workplace savings schemes are designed for around 5 to 10-year employment horizons and DEWS is a strong example of how important it is to offer a range of risk-based investments options with higher growth potential within such schemes.

In an upcoming article, we’ll explore this further by comparing the default options of the two rival plans – DEWS and GO SAVER – in more detail. Please stay tuned!

It will also be interesting to see how the approved fund managers for the UAE’s national scheme under Cabinet Resolution 96/2023 expand their fund offerings (beyond the current capital-protected options which are predominantly money market funds) to include a broader range of risk-based investment choices that cater to the varying risk appetites and financial goals of eligible employees.

Takeaway

To sum up, DEWS has continued its rather strong run in August and looks set to cross USD 1 billion in Assets under Management this September. The topsy-turvy stock market gyrations of the beginning of the year have calmed down, and DEWS’ funds have delivered strong YTD gains…in US dollars.

But there’s a twist.

What if you’re not an American expat? For Europeans, Brits, or Indians with savings in DEWS, currency movements can completely change the picture. This is an important topic for all EOSB savers in the DIFC and across the UAE which we will explore this in a separate follow-up article.

Stay tuned and sign up for our free newsletter today to make sure you don’t miss it!

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | DEWS | 31 Aug 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 31 Aug 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 02 Sep 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.