During the last quarter of 2024, the Dubai International Financial Center (DIFC) approved a second workplace savings plan for End-of-Service Benefits (EOSB): GO SAVER administered by Sukoon Workplace Savings.

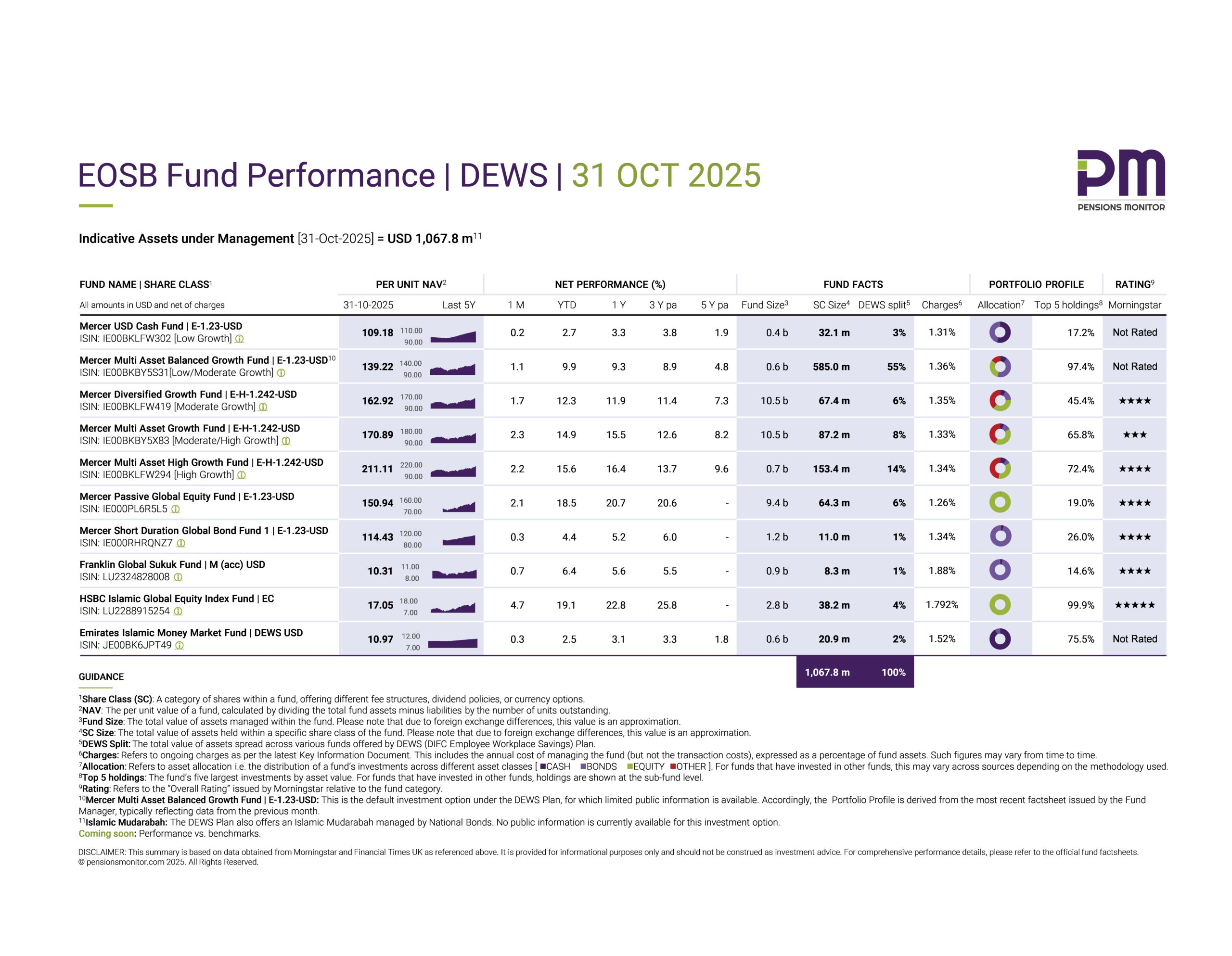

Up until then, companies in the DIFC had only one option – DEWS administered by Zurich Workplace Solutions – which had been the mandatory workplace savings plan for all DIFC companies ever since the traditional gratuity system was replaced with a savings solution back in February 2020. By the end of 2024, DEWS had grown to cover 2,025 companies and 37,435 employees in the DIFC.

Now, with the launch of GO SAVER, each of these companies have a choice.

But why would anyone switch?

It’s a fair question. DEWS is well-known, has been running for years and has a strong track record. GO SAVER is new. So why change from what is familiar?

Here are a few possible reasons:

- Service or administrative concerns: If an employer finds that another Plan better suits their needs in terms of customer support, processes, or reporting, then there could be reason to switch. Employee experiences – such as responsiveness to queries, troubleshooting support, etc. – could weigh in as well, though the ultimate decision to switch Plans rest with the employer.

- Fund performance/fees/fund choice: If employees are not satisfied with the performance of funds under their current Plan or perhaps, they feel the funds in one Plan suit them better than the other, then employers may consider switching Plans to better support the financial goals of their employees. Any such decisions should be taken factoring in all aspects, including both total costs and performance, with external advice taken, should an employer not be comfortable in making such a decision on behalf of its entire workforce.

- Offering employees a choice: Some companies might simply want to give their employees a choice. After all, it is their savings. Allowing employees to pick the EOSB Plan they prefer, can strengthen an employer’s overall benefits package. Here, some may argue that the selection of an EOSB Plan should stay an employer-only decision, much like how group medical insurance is decided by employers, for instance. However, we at Pensions Monitor see it differently. EOSB is not just an annual benefit that resets every 12 months; it’s a long-term savings vehicle that provides access to an investment platform where employees can also make additional voluntary contributions to secure their financial future. So, giving employees a choice is both sensible and strategic, as it not only respects their personal financial goals but also strengthens trust in the workplace.

Finally, let’s not forget that switching is a two-way street. While initially, companies are more likely to move from the established DEWS Plan to the newcomer GO SAVER, over time we can expect to see some switching in the opposite direction as well.

What if your employees have split choices?

That is very possible, especially in a diverse workforce.

For instance, an Indian employee seeking to retire in India, might prefer funds with exposure to Indian equities. A younger expat employee might look for higher-growth, riskier options, while someone nearing retirement may prefer conservative funds or a capital protected option. Similarly, an employee who has actively invested and built portfolios across a range of funds may simply prefer not to switch.

Thankfully, the DIFC rules are flexible.

Employers registered in the DIFC can enroll some employees in DEWS and others in GO SAVER.

This flexibility benefits everyone:

- Employees get to choose the Plan that best suits their personal financial goals.

- Employers strengthen their benefits package by offering a choice and can avoid negative feedback or complaints about “being stuck” with one Plan.

The only real downside is for HR, who will need to handle some extra administrative tasks by uploading data into two systems each month. But again, the ultimate decision to switch Plans or transfer a selected group of employees to another Plan, remains with the employer.

How does the transfer process work in practice?

It is quite straightforward.

- Request Certificate of Compliance from DIFC: The employer initiates a request for a Certificate of Compliance on the DIFC portal. A flat administrative fee of USD 500 is payable to DIFC to initiate this request. The service turnaround time, we have been advised, is between 2 to 5 business days. Note: A Certificate of Compliance is not required for DEWS.

- Register with new Plan Operator: With the Certificate of Compliance in hand, the employer must then register with the Operator of the new Plan. This includes Know Your Client (KYC) checks.

- Inform previous Plan Operator: Once approved by the Operator of the new plan, the employer must notify the Operator of the previous Plan that they are stopping contributions (and the effective date for same). If applicable, Notice of Cessation from the Plan should be provided.

For employers, the top priority during the transition is to ensure monthly contributions continue without interruption. These should not be missed or delayed.

What about the savings accumulated in the previous Plan?

Here, there’s a choice to:

- Leave it where it is: The savings can stay in the previous Plan and remain invested (but fresh contributions will go into the new Plan); or

- Transfer it to the new Plan: Employees can request their employer to have their accumulated savings transferred to the new Plan. Such transfer requests must be communicated to the previous Plan Operator by the employer.

Note: All discretion with regards to the transferring between Plans (including whether accumulated pots transfer over or stay) rests with the employer, who may in turn give their employees this choice.

But transferring EOSB savings from one Plan to another isn’t as simple as moving money from one bank account to another. EOSB savings are invested in funds, which means the units first need to be sold before the money can be transferred to the new Plan, where new units will need to be purchased. While the Plans don’t charge any administrative fees for this, there are some financial implications for employees:

- Transaction costs: Selling fund units may involve costs, and these vary from fund to fund. The exact charges are detailed in each fund’s Key Investor Information Document (KIID). These costs are not separately itemized for employees and are usually wrapped into the fund NAV (Net Asset Value) at the time of sale.

- Processing time: Selling underlying assets is not an instant digital transfer. Divestments and transfers can take days, during which money is “out of the market” and won’t be earning returns. We have been informed that in the DIFC, this disinvestment process should be completed within 10 business days, which will be triggered once the necessary documentation and information requirements have been met by the employer to the providers concerned.

- Price changes: The Net Asset Value (NAV) of a fund can rise or fall during this transfer window i.e. between the date when the transfer is requested and the date it is actually processed. So, the final amount transferred may be different from what was anticipated by the employee.

Whilst the above are standard implications when divesting from funds, switching between Plans is a relatively new concept in the DIFC, so it’s important that companies proactively explain these to employees.

It’s also worth noting that this transfer process follows international best practices. The transfer occurs directly between the trusts of the respective Plans, ensuring that employee assets remain fully secured throughout.

And finally, do employment contracts need updating?

Some DIFC employment contracts may name the specific EOSB workplace savings Plan. In this case, switching EOSB Plans would require contract amendments. If not named, then no changes would be required.

That said, it’s always wise to review contracts at any trigger point and keep proper documentation when dealing with EOSB Plan transfers. In our view:

- If the company switches entirely to another EOSB Plan, a simple company-wide memo may suffice to confirm the change in contributions going forward if your employment contracts do not name a specific EOSB Plan.

- If employees are given a choice between DEWS and GO SAVER, it’s advisable to keep signed requests or acceptance forms from each employee on record.

- And when it comes to accumulated EOSB savings (whether employees opt to transfer the savings or leave in the previous Plan), employers should keep written employee consents on file.

In any case, employers should always seek legal advice on the best way to document these changes to stay fully compliant.

Final thoughts

The arrival of GO SAVER has brought competition and choice to EOSB workplace savings in the DIFC. We at Pensions Monitor believe that such competition is healthy, as it will push plan providers to raise the bar across the board – whether it’s fund choice, fund performance, administrative efficiency, IT tools or member communication.

For employers, it’s a chance to review whether the current plan still works best, or whether another plan might fit better. For employees, it could mean more flexibility to align their EOSB with their long-term financial goals.

The DIFC offers a flexible and straightforward path to switch between plans, but both employers and employees should understand the implications before making a move.

Looking beyond the DIFC, it will also be interesting to see how switching between plans will work under the new UAE EOSB Savings Scheme that is regulated by the Ministry of Human Resources and Emiratisation (MOHRE). Compared to the DIFC scheme, the UAE scheme is still in its early days but over time, switching will become an important topic for the latter as well. We will revisit this topic in due course.

We hope you found this article useful. Sign up for our free newsletter to receive the latest updates on EOSB in the UAE.